The patterns seen in the 1990s Melt Up is repeating itself once again…

Technology stocks are leading the market’s upward trajectory, attracting investors in pursuit of large returns. To the extent that hedge funds are now rejecting fresh capital to catch the new AI boom.

Once again, investors have abandoned mundane value stocks in favor of more dynamic opportunities.

Following the playbook from the late ’90s has proven fruitful for investors. The same sectors that flourished back then are experiencing remarkable growth once more…

I’m referring to technology stocks, semiconductor companies, and any other ventures that offer excitement and robust expansion prospects.

It’s advisable to hold onto these burgeoning sectors as long as the Melt Up persists. However, history shows us that this fervor won’t last forever.

Much like in 1999, investors are leaving traditional value stocks behind. And just like before, this trend is likely to reverse course at some point.

Let me elaborate…

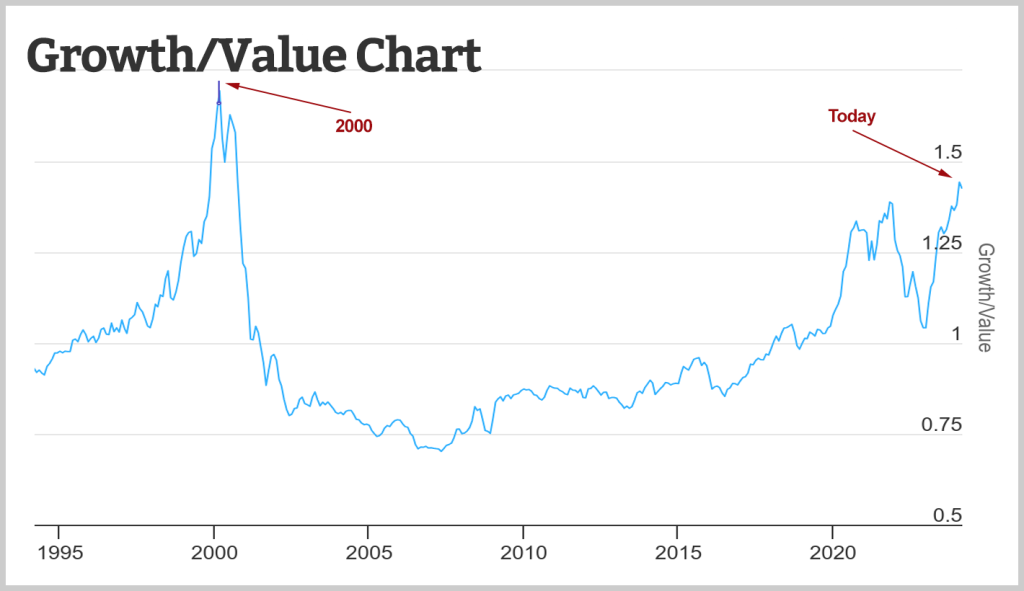

During the final stages of the dot-com boom, the gap between growth and value stocks widened significantly. This is evident in the chart below, illustrating the growth-to-value ratio of the market…

To obtain these results, we simply divide the S&P 500 Growth Index by the S&P 500 Value Index. A rising ratio indicates that growth stocks are outperforming value stocks, mirroring the scenario during the peak of the 1990s Melt Up.

The dot-com era epitomized the allure of growth. Many companies behind these stocks lacked reliable business models, yet investors eagerly bid up their stock price in anticipation of extraordinary gains.

This led to substantial rallies in high-growth sectors during the dot-com boom, which lead to growth stocks significantly outpacing value stocks. However, the ratio peaked in early 2000, coinciding with the conclusion of the Melt Up.

Such is the nature of market cycles. One sector of the market will dominate for a period, only to undergo a reversal just when investors begin to believe in its perpetual dominance.

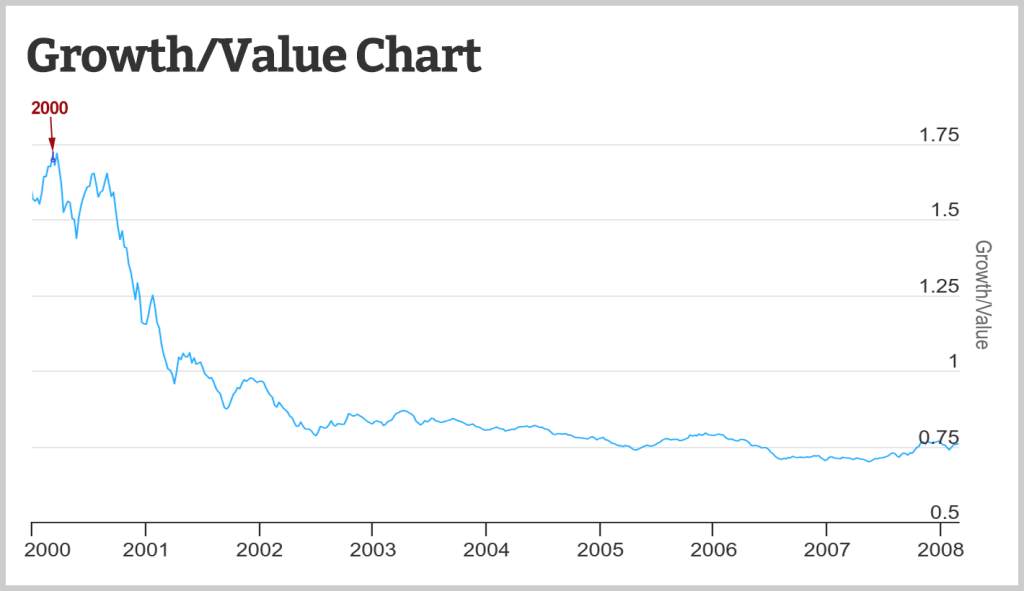

From 2000 to 2008, the ratio favored value stocks. Take a look…

The era of growth had ended. Value stocks that were forgotten about in the late 1990s started to see a resurgence.

Throughout the 2000s decade, the ratio declined, plummeting from its peak in 2000 to a low by 2007.

However, this cycle wasn’t permanent. Growth stocks would eventually reclaim their dominance over value as they always do. This has been evident over the past several years.

From 2009 to the present time, growth has led the market, with the growth-to-value ratio now at an all-time high.

The acceleration in the growth-to-value ratio has been on a tear since October of 2023, and is now approaching levels not seen in about two decades.

The current surge bears a striking resemblance to the scenario in 1999, as the Melt Up approached its highest levels since.

We are likely nearing another inflection point in today’s market. With the ratio nearing all-time highs, akin to late 1999, a reversion to value seems inevitable.

The exact timing of this reversal is uncertain. However, we know that the Melt Up won’t last indefinitely. And when it does conclude – transitioning into a Melt Down – value stocks could prove instrumental in safeguarding your portfolio.

Maybe we are their now or maybe this cycle will continue for a time, but keep this in mind as the era of growth prosperity eventually will draw to a close.

If you’re just getting started with trading, teaming up with a mentor or connecting with fellow traders in a community can make a big difference to your overall returns. They can provide valuable advice and help you navigate the markets. With the right game plan, you can thrive in trading and pave the way for a successful portfolio. Start your journey today by grabbing our free options trading course or stock trading books. It’s the first step towards setting up your portfolio for success.