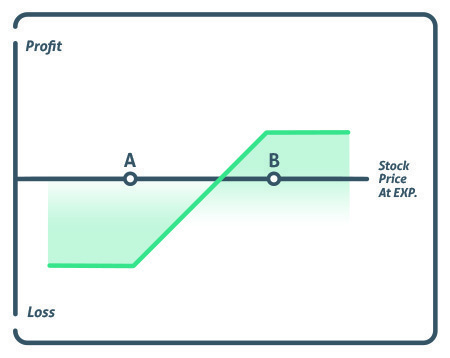

A bull call spread (long call spread) is a vertical spread consisting of buying the lower strike price call and selling the higher strike price call, both expiring at the same time. The strike price of the short call, represented by point B, is higher than the strike of the long call, point A, which means this strategy will always require the investor to pay for the trade. The short call’s primary purpose is to help pay for the long call’s upfront cost.

Profit/Loss

The max profit of a bull call spread is calculated by taking the difference between the two strike prices minus the premium paid. This is reached when the strike trades over the above strike price at expiration.

Max loss is the cost of the trade. This is reached when the stock trades under the lower strike price at expiration.

Breakeven

The breakeven for a bull call spread is the lower strike price plus the cost of the trade.

Breakeven = long call strike + net debit paid

Example

A 55-65 call spread costing $2.50 would consist of buying a 55-strike price call and selling a 65 strike price call, have a $10 wide strike width (65 -55), which is the most the investor could make on the trade, minus the premium paid to get into the trade, in our example $2.50, leaving the investor with a max profit of $7.50.

Time decay is working against the investor if the call spread is out of the money because they need more time for this trade to become profitable. Time would be working for the investor if the vertical has both strikes in the money because they would want this trade to end, so there’s no more time for it to possibly move against them.

Conclusion

The recommendation, this is not a strategy that should be executed very often unless there is evidence of an expected upward movement. Without that it’s a lower probability of success trade that relies on a stock to trade higher. It requires less capital to participate than simply purchasing stock, which means lower risk, but is still considered to be a lower probability of success trade. To learn more about bull call spread option strategy click here.