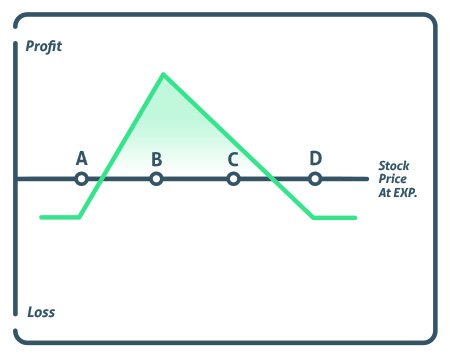

A Christmas tree spread with puts is an advanced options strategy that consists of three legs and six total options. The option strategy involves buying one put at strike price D, skipping strike price C, selling three puts at strike price B, and then buying two puts at strike price A. It is somewhat similar to a butterfly spread, where the desired outcome is a pin at the short middle strikes, but given a more room for the stock to drop in price, thus a more bearish option strategy.

Costs are also higher versus a standard butterfly spread due to the long upper legged strike price that is further away from the short middle strikes. Because the position is opened at a higher cost, the stock must move lower to become profitable. Although it does have a higher probability of a loss, in the event the stock does move against the trader, losses are capped at the opening price.

Profit/Loss

The maximum profit is calculated by taking the difference between the highest strike price and the three short middle put strike price, then subtracting the cost of the trade. For example, if the distance between point D and B was $10 and the trade cost $2.50, then the max profit would be $7.50.

The maximum loss would be the cost of the trade, so with the same example, the maximum loss would be $2.50.

Breakeven

There are two breakeven points. The upper breakeven point would be calculated by taking the top strike price (point D) and subtracting the cost of the trade. So, if point D was a 110-strike price option, and the trade cost $2.50, the upper breakeven would be $107.50.

The lower breakeven point would be calculated by taking the lowest strike price (point A) and adding one-half of the net debit. So, if the point A strike price was equal to $95 and the cost of the trade was $2.50, then our lower breakeven would be $96.25 (95+2.50/2).

Example

If XYZ is trading $110 and is expected to trade lower over the next three months, a trader could execute a 110/100/95 Christmas tree spread by buying one 110-strike price put, selling three 100-strike price puts, and buying two 95-strike price puts for the following prices:

- Buy 1 XYZ 110-strike price put for $8.00

- Sell 3 XYZ 100-strike price puts for $6.90 ($2.30 each)

- Buy 2 XYZ 95-strike price puts for $1.40 ($.70 each)

- Total cost = $2.50

If the stock trades up over the next three months, the investor will have lost his full $2.50, and all positions will be removed from his account.

If the stock trades down to $100 at expiration, then the trader will gain $10 on the stock movement, capitalizing on the 110-strike price option, while the rest of the options expire worthless. Because they paid $2.50 for the trade, their net profit would be $7.50.

If the stock traded down to $90, the investor would make $20 on the $110 put. Lose $10 X3 on the short middle 100-puts for a total of $30. Gain $5 X2 on the long lower 95-puts for a total of $10.

The net result would be $20 – $30 + $10, which mean all the profits are a wash, but because the investor paid $2.50 for the trade, their net loss is $2.50.

Conclusion

The lower a trader sets the strike prices, the more bearish a Christmas tree spread becomes, while at the same time, reducing the cost of the trade. However, the lower the strike prices are set, the lower the probability of success.

This type of spread is sensitive to changes in implied volatility. The net price of the spread drops when implied volatility rises and the price increases when implied volatility falls, meaning it has an inverse relationship to implied volatility changes. The trader who executes this trade wants a drop to implied volatility.

This is not a strategy not recommended for a beginner, only experienced traders should execute a Christmas tree spread options strategy.