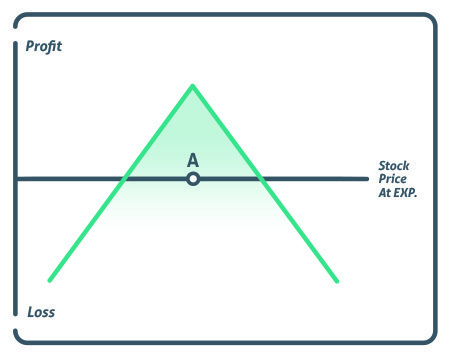

A short straddle consists of selling a call and a selling a put with the same underlying security, strike price, and expiration date. Point A represents this strike price on the chart below. With a short straddle, credit is received and profits when the stock stays in a narrow range. The profit opportunity of a short straddle is limited to the total premiums received. This strategy works best when the stock has little movement until the expiration.

The investor will receive his max win if the stock pins at the strike price at expiration, meaning the investor will win both the call side and the put side, keeping the full premium of both positions. However, if the stock does have a large move, this will hurt the investor.

Profit/Loss

Maximum Gain = Net Premium Received

The maximum loss for a short straddle strategy is unlimited as the stock can continue to move against the trader in either direction.

Breakeven

The breakeven on the top side of the straddle is calculated by adding the premium to our strike price and on the downside subtracting the premium from the strike price.

Top side breakeven: 100.00 + 3.50 = 103.50

Bottom side breakeven: 100.00 – 3.25 = 96.75

Example

If a trader executes a short straddle at the following prices:

- Sell 1 XYZ 100 call at 3.10

- Sell 1 XYZ 100 put at 3.30

- Net credit = 6.40

If the stock pins at $100 then then the trader would keep the full $6.40 and achieve their maximum gain.

If the stock trades up to $110, then the trader would lose $10 on the 100- strike price call, but because they received $6.40 on the straddle, they would have a net loss of $3.60.

Conclusion

This is a market-neutral strategy, which makes the most sense when there is no major announcement or earning scheduled. The traders to executes a short straddle wants the stock to stay relatively stable with little price movement during its duration.

Traders like to sell straddles so that they receive two premiums, requiring the stock to have to move twice as far in either direction before they would start to lose. In most cases, the straddle price is how far the market expects the stock to move from the current price by expiration. This means traders need to be smart and have good timing when executing this type of trade.

Time decay is working for the investor as they’re looking for both options to expire worthless, as time goes on this position decays away, and the position rapidly profits as long as the stock does not have any sharp moves.

Because this trade does have unlimited risk, it’s recommended to be very selective when executing a trade like this and to keep quantity sizing small.