Options trading can be profitable from either the buyer’s or the seller’s perspective. You can obtain value from them during times of certainty and uncertainty; they can also be useful for high and low volatility markets. That is possible because the prices of the assets like commodities, currencies, or stock are always fluctuating, and no matter the scenario, there is an options strategy that can be applied.

Key Points

- Options contracts and strategies that involve the use of multiple options have predefined investment profiles, which makes it very easy to understand the potential risks and rewards of these products.

- When you buy an option contract, the most money you can lose is the initial investment you used to purchase the product. At the same time, the benefits can be technically unlimited.

- When you sell an option contract, the most you can expect to make is the amount that you received in the premium while the losses can be infinite.

- With the adequate strategy, an options trader can benefit from any market situation, from a bullish or bearish market, to high or low volatility scenarios.

- Spread strategies tend to cap the potential profits with the advantage of reducing the premium.

Option Profitability

A call option holder (buyer) stands to make a profit if the price of the asset, for example, the price of a stock, surpasses the strike price defined in the call contract on or before the expiration date. On the opposite, a put option holder stands to profit if the price of the asset falls below the strike price (exercise price) before expiry. The potential benefits can variate depending on the difference between the asset price and the strike price at liquidation or when the option position gets closed.

A call option writer (seller) stands to make a profit if the underlying asset market appraisal stays below the strike price during the contract’s duration. On the other hand, a put option writer profits when the underlying asset price remains above the strike price. The earnings of the option writer in call and put contracts is limited to the amount they charged for the premium.

Option Buying vs. Selling

If an option buyer succeeds in their prediction, the holder can generate a substantial return on their investment, because the difference between the stock price and the strike price can be technically infinite. At the same time, the losses of the buyer are limited to the money paid to purchase the financial product.

An option writer has comparatively a smaller potential to generate huge profits because he’s earnings are limited to the amount he charged for the sale of the contract, the premium. At the same time, his losses can be unlimited because the market price of the asset can go way beyond the strike price.

So, why would someone want to write an option? Well, that’s because the writer will have the upper hand. The options prices are calculated in a way that will be more difficult for the holder to generate a benefit. Most of the time, the options contracts will end up expiring worthless for the holder at expiration. So even though the option writer caps their max profit at the beginning of the trade, their probability of winning the trade is much higher.

You can think of this mechanic similarly to how a casino business works. The gambler (option holder) will take a choice for the chance of earning a lot of money for very little investment. The player will always be in control (or not) on how much money he spends.

While the casino (option writer) will be exposed to lose an infinite sum of money, but this will only happen very rarely. In the longer run, the house will always win by winning many small bets over time.

Risk Tolerance

What would you choose to do? To make a small investment and wager for the trend that an asset will take for the chance of getting a big profit? Or go for the safer bet with limited reward potential but with a small chance of losing a lot of money?

I would recommend beginner investors to stick to long position strategies and risk hedging affairs, as short position investments are still considered riskier since they require more experience and knowledge to execute correctly. In case things go wrong, they can put the investor in a terrible financial situation, but I have a risk-averse profile. But types of investors have different levels of ambition and risk tolerance. With proper research and training, it’s possible to produce a profit speculating from either position.

Risks and Benefits in Option Strategies

Although there are only two types of options contracts, calls and puts. These instruments are often combined to construct more sophisticated investment strategies, but, for now, let’s start by analyzing the risks and rewards of the four most basic ones.

Buying a Call

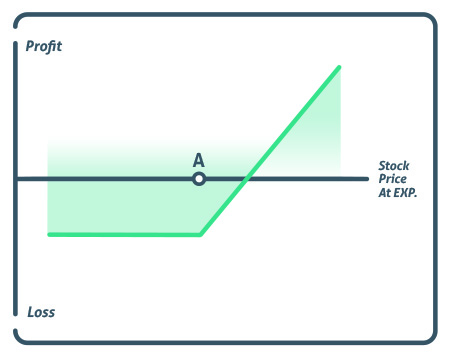

The long call position is the most basic and commonly used strategy. As mentioned before, with this strategy, the call holder is only exposed to losing the invested capital while having an unlimited reward potential; still, the chances of profiting with this position are relatively low.

In the next chart, you can visualize how the profile of the investment looks.

In this position, the objective/wager as an investor is that at expiration, the market value of the underlying asset lands above the agreed-upon strike price. If this happens, the investor would exercise the contract, buy the asset cheaper than market value, and sell it immediately for a profit. But, for the investment to be lucrative, the difference between the stock price and the strike price has to be big enough to counteract the premium paid.

If the opposite happens and the stock price moves below the strike price, the investor won’t have an obligation to exercise the contract, and he would walk away losing the premium.

Buying a Put

This strategy is very similar to holding a call contract, but in this case, the investor’s bet would be on a bearish market. Long put positions are often used by commodities producers to protect themselves from possible market crash situations. Buying puts is a safer alternative to short-selling, but the chances of profiting would be even lower.

The profile of the strategy looks like this.

The prospect of the put holder is less favorable than the call buyer as markets tend to appreciate in the long run, so this option strategy is most commonly used for risk hedging.

Selling a Call

Call writing is the second to most popular options strategy used by institutional investors. Sophisticated investors often sell call contracts over assets that they already held within their portfolios. They do this with the expectation of earning extra revenue from their portfolio through premium money, and in case the asset over appreciates, the appreciation of their stock would cover their position. Applying this strategy is known in the finance world as a synthetic short put position.

Next is the profile of the short call strategy.

Admitting the fact that short positions are more profitable in the long run, they are still considered riskier than long positions, since they are exposed to tremendous loss. So, option writing is usually reserved for intermediate and institutional investors, who have the expertise to appropriately calculate the premium and have the economic power to back their investments.

Selling a Put

Writing puts is the preferred strategy of institutional investors since objectively; this strategy has the highest chances of obtaining a return. If the put owner exercises his right and forces the writer to buy the asset over retail price, the writer would be able to keep the asset and sell it when prices eventually bounce back. Still, of course, this would only lead to more speculation, and the asset prices could tank even more.

This strategy’s profile is, by definition, opposite to holding a long put position.

The objective of the option writer is to calculate a premium advantageous enough that would be very hard for the holders to obtain a profit but still make the offer attractive enough to investors.

Option Spreads

As stated earlier, options contracts are rarely used individually in professional portfolios. They are often combined to create more complete investment strategies, which are known as spreads. Most simple spreads are used to speculate into bearish or bullish markets with the added benefit of reducing the premium paid, however, maxing the available benefits, but since gaining an immense return with long positions is highly improbable, this is not a problem. Spread strategies can be created to take advantage of any market circumstances.

Selecting the Right Option

Here are some tips that should help you make a smarter choice while trading with options.

Bull and Bear Markets

Single long position calls and puts are sometimes utilized to speculate on prices drops and rises. But a more rational proposition would be to make use of a bull or bear spread strategy.

For example, in a rising market, a bull call spread is applied by purchasing a call with a low strike price and then selling another call with a higher strike price, thus amortizing the premium paid but limiting the potential benefits. A similar strategy is used for bear market; a bear put spread strategy consists of buying a put at a higher strike price and then selling another one with a lower strike price.

For traders who want to give themselves an extra cushion, in case there often their timing, they can utilize the bear call spread or the bull put spread. Here if the investor thinks the market is going to stay flat or trade lower, they can sell a call above the current stock price, then purchase another call, as a hedge, a strike price higher than the one they sold. This way, the investor to keep a premium while limiting their risk to the upside.

The same thing may also be done if an investor thinks the market is going to trade higher. Here they could implement a bull put spread by selling a downside put, then purchasing another put at a strike price below the one they sold. This way if the market trades flat or higher than investor will keep the premium they received profit.

Volatility

How volatile is the market? Assets have two types of volatility ratings, historical volatility, and implied volatility. Historical volatility measures how drastic the price changes of the asset had been in his lifetime; meanwhile, implied volatility represents how the option market thinks the volatility of the asset is going to behave in the future. These two metrics can help investors to consider an asset as volatile or not. For volatile markets, there are spread strategies that take advantage of this scenario. For high volatility assets, a long straddle strategy is often applied or a Short Butterfly strategy as a cheaper premium alternative.

Expiration

The farther the expiration date is, the higher the chances the stock price has of reaching the strike price, thus augmenting the value of the contract. As the contracts get closer to expiration, the uncertainty factor of the options contracts gets more negligible. For that reason, more extended time-lapse contracts are precarious for option writers. The investors that can find the proper balance between risk/reward are most likely to have the best future results.

Conclusion

Even though short positions can be more profitable in the long run, these strategies should be left to sophisticated investors that do proper risk management, which means understanding the option delta all the way to interest rates, while use industry-leading standards to calculate the premium. The only exception is when the investor implements a spread in order to limit their risk. Nevertheless, this shouldn’t scare you from investing in options and with a responsibly build strategy is possible to receive high returns. Those who learn how to trade options properly, using the right strategy for the right situation and up smashing average market returns over time. Don’t just take investment advice from anyone, click here to apply expert research to your own portfolio.