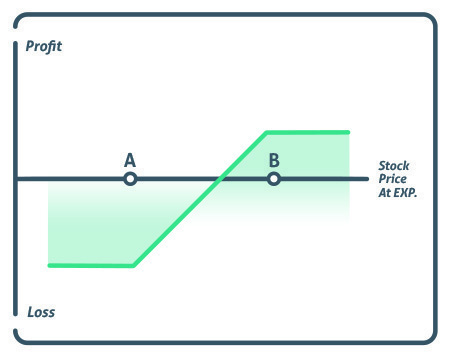

The Bull Put Spread is a vertical spread strategy where the investor sells a higher strike price put option, shown as point B, and buys a lower strike price put option, point A, within the same expiration month. The investor will receive a premium or credit, as the higher strike price put will have more value than the lower strike price put.

The investor uses this strategy if they believe the market will stay flat or trade higher. The lower put option is used as a hedge in case the market does trade lower, so the investor can cap their max loss.

Profit/Loss

The most an investor can expect to make on this trade is the credit they received. If the stock finishes above the higher strike price at expiration, the investor will achieve max profit.

The max loss can be calculated by taking the two strike prices minus the premium received. This is reached when the strike trades over the above strike price at expiration.

Breakeven

The breakeven for a bull put spread is the higher strike price minus the premium received.

Breakeven = short put strike – premium received

Example

A 70-75 bull put spread valued at $2 would consist of selling a 75-strike price put and buying a 70-strike price put. Here the $2 premium would represent the max win if the stock stayed above the 75-strike price. Having a $5 wide strike width (70 -75), representing the max loss if the trade finishes below both strike prices, minus the premium received to get into the trade, in our example $2, leaving the investor with a max loss of $3.

Time decay is working for the investor if the put spread is out of the money because they want the trade to expire, allowing them to keep the full premium received. Time will be working against the investor if the vertical has both strikes in the money because they would want this trade to continue, giving them more time for the stock to rise in price.

Conclusion

This is a great strategy to use if the investor feels a stock is going higher, but not sure on their timing or wants to giving themselves a cushion in case the market moves sideways or trades down slightly.