Time is one of the most important factors in options trading…

When we buy options, whether a single strike price or a vertical spread, we have to be right about the direction of the underlying stock as the options become less valuable with the passage of time.

On the flip side, we don’t have to get this stock direction correct when we sell options. We have to be sure the options don’t move too far in the wrong direction. This will allow us to profit as the options decay.

Sellers typically win because options are continually decaying, thus losing value, giving sellers the advantage right from the start.

However, there is an options strategy that will allow us to make a minor directional play in the stock while also canceling out our exposure to time, which in the options world is known as “theta.”

This strategy is known as a calendar spread or time spread.

When traders implement a calendar spread, they are not betting on a swift movement in the stock. They need the stock to either remain flat or slowly move in the desired direction, then let time decay do the work.

If a trader feels like timing the market will be difficult due to low volatility or calm markets, then a calendar spread may be a good fit.

Calendar Spread Example

Let’s say we want to invest in stock ABC which has the following parameters.

- Stock price: $96

- One-month 100-strike price call options cost: $2.75

- Three-month 100-strike price call options cost: $6.50

The first thing we need to consider is the option’s intrinsic value. The intrinsic value represents how far the options are in the money.

With the stock trading at $96 and both months call options sporting a 100-strike price, there is no intrinsic value. These prices are entirely made up of time value, which means as time moves forward, both call options will erode.

After one month, if ABC’s stock price remains relatively the same, the one-month call option will be worth $0, yet the three-month option will still retain value as it has two months before it expires.

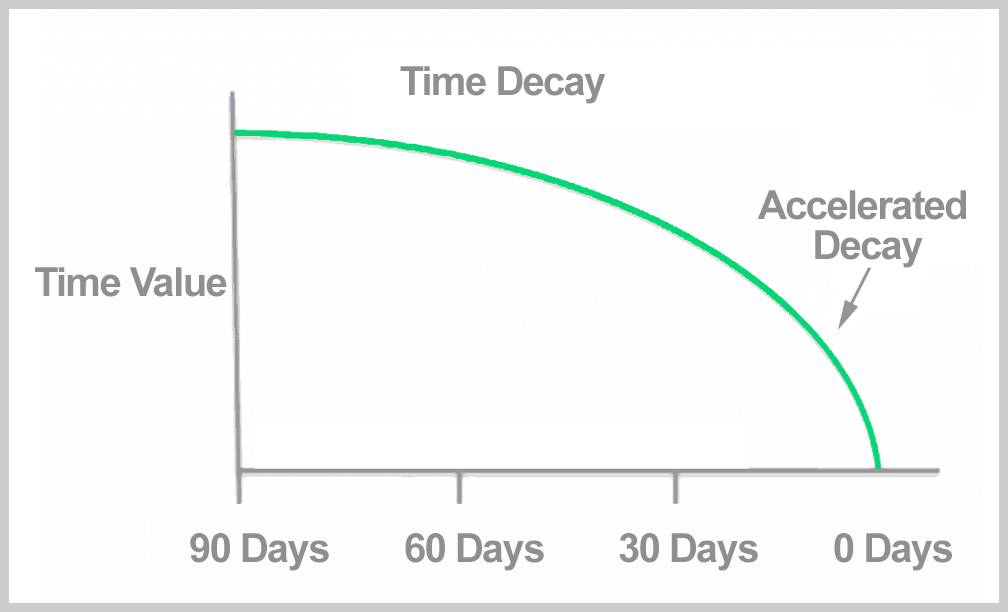

This structure benefits the calendar spread as options decay quicker as they get closer to expiration.

This is the basis behind the calendar spread…

If the stock stayed at $96 after one month, the short-term option would expire worthless, and we would pocket $2.75. The three-month option would also lose value, likely dropping its value to about $5.00, which means we would’ve lost $1.50 for the longer duration ABC option. In total, we would’ve made a profit of $1.25 ($2.75 – $1.50).

Because we initially invested $3.75 ($6.50 – $2.75), we would have a 33.3% ($1.25 / $3.75) return after one month. Overall, that is a fantastic one-month return on capital!

Let’s switch gears and say after one month, ABC trades up to $99.50. That is close to our strike price but still under.

The one-month option would still have a value of $0 at expiration. Yet, despite the time decay, our longer-term option would have gained value due to stock movement. Here our longer-term options would have a value of about $3.25.

Overall we would’ve made a profit of $2.75 from the one-month option expiring worthless, and we would’ve made $.50 ($3.25 – $2.75) from our three-month option gaining value.

With this scenario, we would’ve bank a total profit of $3.25 ($2.75 + $.50), bringing our total one-month return to 86.6% ($3.25 / $3.75).

We were able to make such a fantastic return because we selected a stock that had positive moderate stock movement. For this reason, it is best to implement a calendar spread when we anticipate little movement in the stock, yet we expect it to move slightly in our direction.

If we expect the stock will have a slight bullish movement, we would want to implement an out-of-the-money call calendar spread, and if we expect a slight bearish movement, we would want to implement an out-of-the-money put calendar spread.

Even though the calendar spread may appear like an easy-win options strategy, if it moves too much in either direction, we will lose money on the trade.

Because we are short a call option, if the stock were to run higher and move into the money, we would be obligated to deliver shares of ABC at $100. For example, if ABC traded to $105 at expiration, we would be obligated to buy the stock at $100 and then sell it at $105, resulting in a $5.00 loss.

However, because we were long a three-month 100-strike option and ABC, we would’ve had a $5.00 gain, covering the short option loss. So here, we are fully protected if the stock runs higher, yet we would lose our initial investment of $3.75.

Likewise, if the stock were to fall to $90, neither option would ever have any intrinsic value, and we would also lose our initial investment of $3.75.

So as you can see, it is essential that when implementing a calendar spread, the stock remains relatively flat or moves mildly closer to the strike price.

Choosing the Best Strike Price

When implementing a calendar spread, selecting a slightly out-of-the-money strike price is usually best. At-the-money strike prices will result in the highest profitability. However, giving our self a little cushion is smart, while still allowing plenty of opportunity to profit.

Which months to choose is always up for debate, but options decay much quicker at around six weeks. Here it is best to sell an option with around one month to expiration and then buy an option with two to four months to expiration.

At OptionStrategiesInsider.com, we generally prefer to buy an option with three months to expiration. This way, we can close the trade when the first option expires or sell another one-month call option against our long position. If the stock rises to the strike price when the first-month option expires, we also have the option to adjust the trade into a diagonal spread.

Trade Profitability

To calculate our total return on the calendar spread, we must first compute the cost to open the trade. We can then calculate the cost to close to trade. If our calendar spread was done successfully, the shorter-term option should have zero value, resulting in maximum profit on the first leg of the trade. We would then add this profit to the profit or loss on the second leg.

We can also take advantage of online tools to calculate option P&L, such as the one found at Options Profit Calculator. Just enter the details of the long call along with the number of days to expiration after the short call expires.

Conclusion

The goal of the calendar spread is to have the stock as close as possible to the shorter-term option when it expires. It’s essential to keep a close eye on the spread as expiration approaches. If the stock starts to put the options in the money it is often wise to close to trade so that none of the options get exercised.

The calendar spread might seem difficult initially, but it is one of the higher success rate options trading strategies and one you should add to your toolbox.

If you want to learn how to implement calendar spreads like a pro, along with several other options trading strategies, please sign up for our free options trading course by clicking here.