For some background you can read some of my previous articles:

One of the major trends of the 2020’s will be autonomous vehicles [AVs] used as robotaxis, known as Autonomous Ride Services [ARS], helped by the recent development of the ‘million-mile battery’. There will be different types of services (fixed route, variable route, taxi, ride share) depending on the offering. Fixed route services have already begun in parts of the USA and China, but should grow rapidly from here. Variable route services can potentially follow if the technology allows. Taxi services will be similar to today but with no driver. Ride share will probably end up being the most profitable and cost effective with one vehicle having several paying customers.

Ride sharing services (Lyft, Uber etc) which typically charge ~US$2/mile will need to become autonomous otherwise they will not be competitive, as autonomous ride services will be profitable at ~US$1/mile.

It should also be noted in the future that ALL autonomous vehicles will need to be fully electric vehicles [EVs] in order to be competitive. This means those companies able to rapidly build out a battery electric vehicle [BEV] fleet have some initial advantage.

Autonomous vehicle revenues will be spread across several areas such as the software developers, hardware developers, the EV companies selling EV fleets, and finally the robotaxi services. The later looks like being one of the biggest opportunities so this article focuses on that.

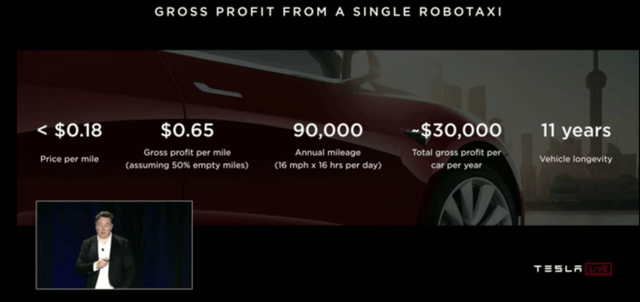

A single robotaxi charging US$1 per mile and traveling 90,000 miles pa (50% of miles with a passenger) could earn US$45,000 pa. The revenue is then roughly divided up as total car costs 1/3 ($15K), vehicle owner 1/3 ($15K), AV service provider 1/3 ($15K). In many cases the AV service provider will also own the vehicles meaning they can achieve $30,000 pa gross profit per robotaxi. Given the service will operate automatically via an app the profit margin is extremely high. Almost all the $30,000pa will be profit.

If a company was able to rapidly scale to having a 1 million robotaxi fleet that could amount to US$30 billion per annum of gross profit at super high margin so effectively US$30 billion of profit pa. This model requires huge CapEx to own all the vehicles but payback on a 10-12 year vehicle life is just 1-1.5 years.

Note: If the 1m robotaxi fleet was owned by private car owners the CapEx is passed to the vehicle owners, but gross profit pa would drop to US$15m pa (1m x $15K).

Note: If the robotaxi ran set routes and took multiple passengers the revenues could reach or exceed $100K pa. In that case the robotaxi could potentially earn ~US$85,000 pa and a 1m fleet ~US$85b pa. Of course as competition in the sector intensifies the US$1/mile may drop thereby reducing revenues.

Elon Musk forecasts US$30,000pa gross profit for a robotaxi

Source

Forecasts

- Grand View Research – The global autonomous vehicle market demand is expected to reach 4.2 million units by 2030, expanding at a CAGR of 63.1% from 2020 to 2030.

- Tesloop+Morgan Stanley Investor Explanation (video) – “Global mobility is equal to 100 x US$100b”. That calculates to be a US$10 trillion global market.

- McKinsey (2019) – “Autonomous vehicles will likely shift a substantial share of the mobility market value away from products (that is, buying vehicles) and toward services (that is, paying for transportation per mile)…. Within this mix of opportunity and uncertainty, we believe AV players (from components vendors to mobility service providers) could earn trillions in revenues in China.” And for China – “In our base forecast, such vehicles could account for as much as 66 percent of the passenger-kilometers traveled in 2040 (Exhibit 1), generating market revenue of $1.1 trillion from mobility services and $0.9 trillion from sales of autonomous vehicles by that year.

A pic showing an autonomous vehicle in action

In a May 2020 update article on AVs by Bloomberg they state:

Self-driving cars are already charging fees in places such as: sunny Phoenix, where Lyft customers order up Waymo minivans; Texas, where Kroger groceries are ferried around by windowless, driverless pods from Nuro; and Florida, where Voyage zips octogenarians around one of the country’s largest retirement communities. Silberg calls these “islands of autonomy,” relatively static areas that have been thoroughly scanned, mapped and stress-tested by artificial intelligence algorithms. In the next two years, they’ll start popping up all over the place, he reckons.

A look at the leading players in the robotaxi race and the possible near term winners

Alphabet Inc. (GOOG) (GOOGL) – Waymo

Waymo One is Alphabet’s self-driving taxi service which uses set mapped out regions to run its service. They also have Waymo Via their AV delivery service. Waymo state that their Waymo driver (meaning AV) has over a decade of experience and driven over 1 million miles (Bloomberg quotes 20+ million miles).

In December 2018 Waymo One launched self-driving cars in Phoenix. Their main cars have been 600 Fiat Chrysler Automobiles (FCAU) Pacifica Hybrid minivan. In March 2018, Jaguar Land Rover announced that Waymo had ordered up to 20,000 of its planned I-Pace electric cars. Waymo use Intel (INTC) chips. You can read more here.

Bloomberg reports in total that Waymo has 600 vehicles with deals to buy 82,000 more. In May 2020 Bloomberg stated:

Today, if you want to pay to ride in a truly driverless car, there is only one place in the country to do it: suburban Phoenix, where Waymo carries fares with no safety drivers in a handful of the Chrysler Pacifica vehicles. The general consensus in the industry is that Waymo remains ahead of the competition by a year or more, based on several milestones.

In early December, Waymo’s autonomous taxi service topped 100,000 rides in the first year of its Waymo One pilot program in Arizona; in July 2019, those robo-taxis plugged into Lyft’s metro Phoenix network, expanding ridership well beyond Waymo’s base of 1,000 or so beta subjects; and in October 2018, Waymo secured a permit from the state of California allowing it to operate its cars without a human safety driver aboard, the first such certification.

Waymo is testing commercial applications of 18-wheelers made by Peterbilt, a unit of Paccar Inc., outfitted with its self-driving technology. Trucks also have been tested on public roads in California and in the Southwest, as well as on closed courses in Michigan.

My view is that Waymo/Alphabet is likely to be one of the top three winners in the robotaxi race and that they are the current leader.

Waymo plan different autonomous vehicles

Source: Home – Waymo

Tesla (TSLA)

Since October 2016 all Tesla vehicles were built with Autopilot Hardware 2, a sensor and computing package the Company said would enable “full self-driving” [FSD] capabilities once the software matured. In July 2020 Elon Musk stated that FSD is “very close”.

BBC News quoted in July 2020:

Tesla will be able to make its vehicles completely autonomous by the end of this year, founder Elon Musk has said….It was already “very close” to achieving the basic requirements of this “level-five” autonomy, which requires no driver input, he said…..a future software update could activate level-five autonomy in the cars – with no new hardware, he said.

Once fully autonomous level 5 is rolled out via over the air updates Tesla plans to offer Tesla owners and potential taxi customers access to the robotaxi network. Tesla will have a smartphone app with choices – “Summon a Tesla”, “Add your car to the fleet”, “Subtract your car from the fleet”. Musk sees a future where the robotaxis would return home and automatically park and recharge.

Tesla is differentiated by using cameras for vision and no lidar and according to Musk their in-house Tesla chip has significantly faster data processing capacity than any of their competitors (Nvidia disagrees). Bloomberg report that Tesla had 1 billion miles with autopilot engaged as of November 2018. They also state that the “current Tesla owners are training the system constantly, both when Autopilot is engaged and when it is in “shadow mode.””

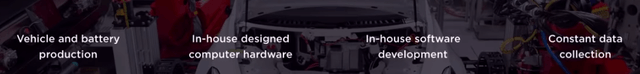

Tesla’s advantages are significant and include – By far the largest fleet of potential BEV robotaxis in their owner network, their own software and hardware, and more miles of data collected than any competitor. All of this together means Tesla believe their robotaxi costs will be “around $0.18 or less per mile”. Furthermore Tesla’s visual system can adapt to any and all locations, and would not need to be on highly mapped out routes as per some of their competitors that rely more on mapping.

Tesla may have a cost advantage in robotaxis due to vertical integration

Source

My view is that Tesla can be a low cost leader and winner in the robotaxi race. In fact I think Tesla will most likely become the leader in robotaxis due to their advantages discussed above. To be truly competitive in the mid-term I would like to see Tesla develop an autonomous electric mini-van/shuttle (people mover with about 12+ seats) or e-bus next. Tesla plans to use Models S, 3, X and Y as future robotaxis and Tesla semi & Cybertruck could also be AVs.

The rollout and hence revenues should start during slowly in 2021 (subject to regulatory approvals) and grow cumulatively each year. My article linked below shares my model and the potential impact on Tesla which can be very significant.

General Motors (GM)/ GM Cruise

GM Cruise has the world’s second-largest autonomous fleet of 180 vehicles that are undergoing testing, with more than 1.6 million kilometers (1 million miles).

GM had planned their AVs rollout in 2019 but has been delayed. GM has already partnered up with Lyft to offer rides from its autonomous fleet.

GM already has its own BEV the “Bolt’ which gives them some advantage over others. GM and Honda have developed Origin, a shuttle vehicle purpose-built for autonomy.

The autonomous Cruise Origin shuttle

Source

Bloomberg reports:

GM is trying to launch an autonomous ride-hailing service in San Francisco…..executives say they hope it will happen soon. In preparation, Cruise has hundreds of its cars being tested in San Francisco. Vogt, now the company’s chief technical officer, has said that if a car can navigate San Francisco, it can handle any kind of driving. Cruise is using modified versions of GM’s Chevrolet Bolt electric car.

GM Cruise’s autonomous vehicle, the all electric Bolt

Source

Argo AI (Ford (F)/Volkswagen [Xetra:VOW](OTCPK:VWAGY) (OTCPK:VLKAF))

Argo AI is backed by Volkswagen & Ford. Argo already has robotaxi and driverless delivery pilot programs in Miami, Washington, Detroit, Pittsburgh, Austin, Texas and Palo Alto, California. Argo is run by CEO Bryan Salesky, once a leading figure in Google’s self-driving car project and Pete Rander, previously a founder of Uber’s self-driving program.

Ford plans a multi-city commercial rollout of robotaxis and driverless delivery pods in the U.S. in 2022.

Amazon (AMZN)/Zoox

Amazon recently announced a billion dollar deal to buy self-driving company Zoox. Prior to this Amazon announced an order for 100,000 Rivian electric delivery vans by 2030. Adding these two news items together along with Amazon’s drones, it looks highly likely that Amazon plans to be a major player in autonomous delivery. This will cut costs for their consumers and give them a further competitive edge. As for robotaxis, maybe that will be next given Amazon’s history of disruption.

In December 2018, Zoox became the first company to gain approval for providing self-driving transport services to the public in California.

Apple (AAPL)/Drive.ai

Apple has been working on autonomous vehicles as well as their ‘on and off again’ electric car program dubbed ‘Project Titan’ which first began in 2014. In 2019 Apple bought Drive.ai, an autonomous driving startup based out of Mountain View, California.

MacRumours states: “What we know”

- “Physical car project possibly still in the works.

- Deep integration with iOS expected.

- Autonomous testing permit received from the California DMV.

- Self-driving software being tested…..

- Reliable Apple analyst Ming-Chi Kuo also believes that Apple is still working on an Apple Car that will launch between 2023 and 2025….

- Apple is also working on a self-driving shuttle service called “PAIL”, an acronym for “Palo Alto to Infinite Loop.” The shuttle program will transport employees between Apple’s office in Silicon Valley.

- (According to German website Manager Magazin) Apple’s industrial design group has created prototypes of a van with black and silver finishes, indicating the Apple Car could be an Apple Van.”

Apple is currently testing its AV software platform in several 2015 Lexus RX450h SUVs in California. As of May 2018, Apple had 70 vehicles out on the road using its autonomous driving software.

Apple has the brain power and the money, which is why I rate them as the dark horse chance to swoop from behind in the robotaxi/AVs race, most likely with a robotaxi shuttle would be my guess.

Some recent independent ideas on what an Apple iCar may look like

Source

Others

- Pony.ai (major backers are Toyota, Sequoia Capital China, IDG Capital and Fidelity’s Eight Roads). Pony.ai runs a pilot service in Irvine California, and was the first to launch a robo-taxi fleet and service in Guangzhou China in 2018.

- Aptiv (APTV)/ Hyundai Motor Group (OTC:HYMTF) – APTIV acquired Nutonomy and is working with Intel (INTC), then later formed a 50/50 JV with Hyundai. They plan robotaxis by 2022 and may work with Lyft.

- Aurora Innovation (private) (backed by Hyundai Motor Group, Amazon.com Inc. and Sequoia Capital). Aurora plan to supply multiple car OEMs with an AV complete package.

- Nuro (NURO) (backed by Softbank) with a focus on pizza and grocery deliveries.

- Other car companies including BMW (OTCPK:BMWYY)/Daimler-Mercedes (OTCPK:DDAIF, OTCPK:DDAIY), Toyota (NYSE:TM), Nissan (OTCPK:NSANY), Volvo,

Added to the above are the existing ride sharing companies Uber (UBER)/Yandex (backed by Toyota, Denso and SoftBank Vision Fund), Lyft (LYFT), Didi Chuxing, Grab Taxi, Ola, Gett, Mytaxi, and DriveNow. Note that the ride sharing companies already have established taxi customer bases, but they will need to move very quickly to autonomous or risk losing massive market share.

Note: There are literally hundreds of companies working on autonomous vehicles or somewhere in the AVs supply chain. For example Nvidia (NVDA) is a leader in AV software and solutions.

The Chinese ARS companies

Several Chinese companies are already operating Level 4 ARS mostly in China, with Level 5 (no driver in the vehicle) expected by ~2022/23. The leading companies are listed below. These are definitely worth investing in if you have an appetite for Chinese stocks.

- Baidu (BIDU) – Baidu developed a platform that others can use called Apollo. The concept being the “Android of the autonomous driving industry.” In July 2018 China’s Baidu rolled out self-driving buses. At that time, Baidu’s AV Apollo platform now has 156 global partners, and had been used by over 12,000 developers and partners worldwide. Baidu has a fleet of more than 300 Level 4 test vehicles across 23 cities and has recently surpassed 3 million kilometers in urban road testing, putting it first among China’s AV developers.

- AutoX (backed by Alibaba (BABA) & Dongfeng Motor)

- Didi Chuxing (backed by Softbank (OTCPK:SFTBY),Tencent (OTCPK:TCEHY) & Alibaba) plans to have 1m robotaxis by 2030.

- Pony.ai (private) (backed by Toyota), Hyundai

- WeRide (Baidu backed)/Nvidia

AutoX backed by Alibaba is hoping to have Level 5 robotaxis by 2022/23

Source

Bloomberg’s ratings for the autonomous vehicle sector as of May 2020

| Leaders | Waymo | GM Cruise | Argo AI | Aurora | Aptiv | ||

| Posses | Baidu | BMW | Daimler | Nuro | Toyota | Uber | Volvo |

| Rogues | Nissan | Pony.AI | Tesla | Zoox |

Source: Bloomberg

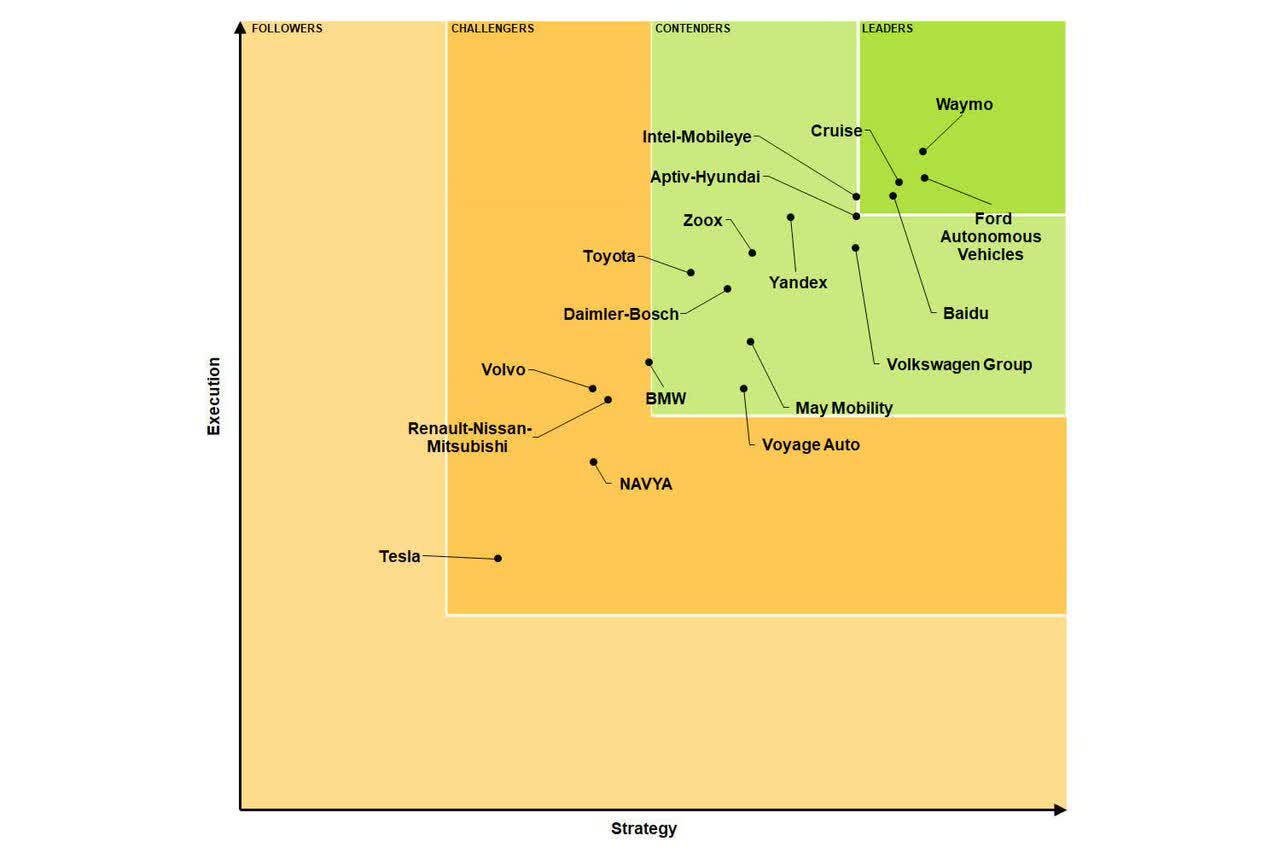

Navigant Research’s rankings of leading autonomous vehicle companies

Source

The future of transport

It should be pointed out that robotaxis circulating around being empty 50% of the time may not be a realistic future. Most city traffic problems are bad enough now without adding in robotaxis with no passengers, especially in rush hour.

Realistically governments will work towards traffic decongestion and reducing emissions; which will mean more and more electric mass transport vehicles such as electric trains, monorails, buses, shuttles (mini-vans), EVTOLs etc. This makes me think set route robotaxi e-buses or e-mini-vans/shuttles should do very well. Companies that focus on these types of vehicles should also do very well.

A BYD electric monorail

Source

Bidu’s autonomous mini-bus/shuttle in China

Source

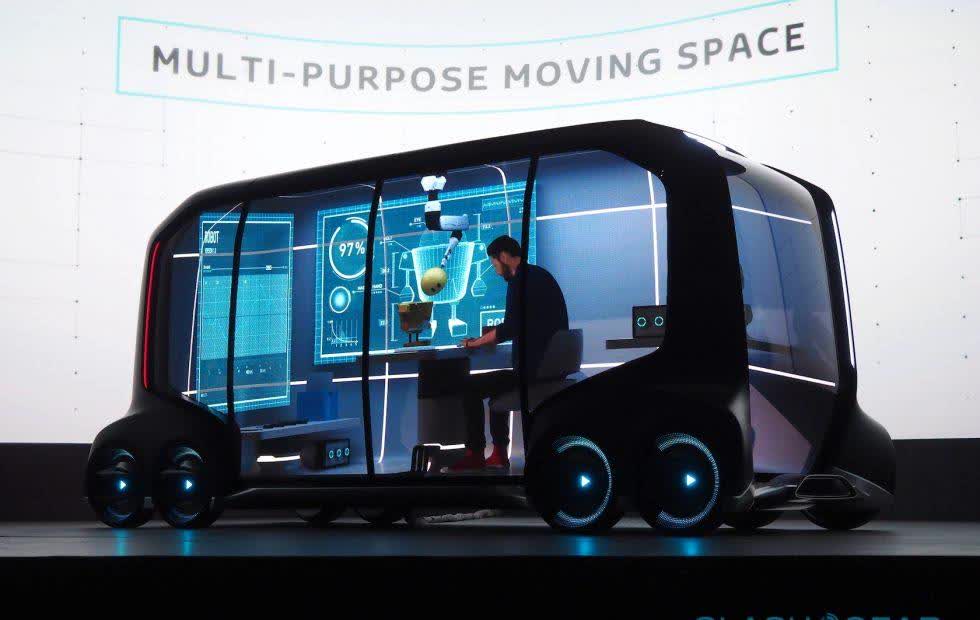

Toyota’s e-palette concept autonomous vehicle

Source

Amazon Scout – Autonomous fully-electric delivery

Source

Risks

- Technology risk in developing and maintaining autonomous vehicles and a robotaxi network.

- Litigation risk – The risk of AV companies being sued for accidents etc. Insurance companies will have a say in this also. Some plan to self-insure.

- Regulation risk – Governments are still gradually opening up areas for autonomous driving.

- Public acceptance issues around AVs. I think the huge drop in taxi costs per mile will rapidly bring customer acceptance provided accidents are low.

- Access to electric vehicles. Not all AV groups will be able to rapidly scale up a robotaxi network due to a shortage of EVs. Large EV makers such as Tesla have an early stage advantage.

- Company risks – Debt, liquidity, management etc.

- The usual stock market risks – Liquidity, sentiment.

Further reading

Conclusion

Shared autonomous electric transport will be a massive disruptive trend this decade. Electric robotaxis (especially shuttles) could be extremely profitable and earn anything from US$15,000 to $85,000+ pa per vehicle for robotaxis/ARS companies. For a 1m robotaxi fleet this equates to US$15-85b pa of very high margin gross revenues. Clearly this is a huge prize and explains why the biggest names are chasing it.

Autonomous vehicles will come in all shapes and sizes. There are three key elements for success – Effective software, electric vehicles, and licensing & regulation.

I think the companies that can grow their robotaxi network of EVs (and charging stations) the fastest with the lowest cost base have the best chance of gaining rapid market share, and ultimately being the winners. This gives EV manufacturers such as Tesla an early mover advantage.

Companies that can succeed in ride sharing AVs which carry multiple passengers (e-SUVs, e-mini-vans, e-shuttles, e-buses, etc) will do the best. More people per vehicle means more revenue per vehicle per mile. There is also the delivery sector for AVs that can do very well (includes smaller EVs such as e-drones, e-bikes and e-tricycles, e-trucks, e-semis).

My view for now is that the leading companies in the robotaxi race are Alphabet Google (Waymo), Tesla, General Motors, and Argo.AI (Ford/Volkswagen). I would not be surprised to see Amazon and Apple complete the list in leading AVs in the near future. Added to this group there are several Chinese companies led by Baidu, and include AutoX and Didi. There are also numerous other auto manufacturers and other companies working on AVs. For the software side it looks like Tesla and Nvidia lead.

At some point competition will increase so the first mover and cost advantages are important considerations, as well as getting the right vehicle mix.

The sector still faces various risks but the rewards for success are potentially enormous.

As usual all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I’ve done, especially in the electric vehicle and EV metals sector. You can learn more by reading “The Trend Investing Difference”, “Subscriber Feedback On Trend Investing”, or sign up here.

Latest Trend Investing articles:

Disclosure: I am/we are long GOOG, TSLA, Renault [FR:RNO]. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.