Elliott Wave Principle is the famous rule of thumb developed by Ralph Nelson Elliott in the 1930s when he discovered that stock market prices tend to reverse in recognizable patterns. Elliott Wave Principle can help traders identify trends, spot trading opportunities, and make sound decisions around their investments.

The Elliott Wave Principle

The Elliott Wave Principle is a system of understanding how markets work. It helps to explain why stocks and prices go up and down and how waves can form in stock prices. The principle can be applied to any market situation, regardless of the size or composition of the market.

To apply the wave theory to your own life, keep in mind these three key points:

- Stock prices are always influenced by news (the weather, economic conditions, etc.), which can shape stock prices in a variety of ways

- Waves are created when different factors interact with one another

- When waves form in a market, it means that there is some risk associated with the stock price

The Elliott Wave Principle: How to Use It

The Elliott Wave Principle is a guide to understanding how markets work. It can be used to understand how stock prices move, how waves of market activity happen, and how to identify patterns in the data.

The main idea behind the Elliott Wave Principle is that it usually follows a specific pattern or wave when a trend is identified. The principle can be broken down into three main areas:

- The pattern or wave itself – this is what you need to look for to determine whether or not you’re seeing an Elliott Wave

- What caused the trend – this is important for identifying factors that may have contributed to the current market conditions

- How to exploit the trend – this is important for predicting future market action

The Elliott Wave Principle: Applications

The Elliott Wave principle is a guide to understanding how markets work. It helps identify when market trends are changing and how to place orders to profit from market fluctuations.

This principle is used extensively in financial analysis, helping you to predict future prices and outcomes better. In particular, it can be used to understand the behavior of stocks, currencies, and other financial assets.

How Do You Do Elliott Wave Trading?

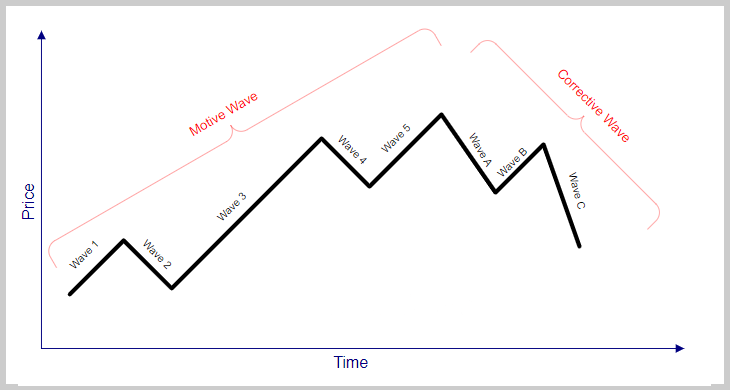

To map out Elliott waves, traders need to recognize the five wave pattern that takes the form of a specific structure. Three of the five waves, labeled one, three, and five, are the drivers of the directional movement of the stock. Two countertrend waves separate them labeled two and four.

Because stocks do not move in a straight line, these countertrends briefly interrupt the directional nature of the wave.

Wave Construction

Traders must become familiar with two types of waves: impulse (or motive) waves and corrective waves. Waves one, three, and five are the impulse waves that drive market direction. Waves two and four are the corrective waves that give a brief break to the overall move.

A three-wave corrective wave pattern follows impulse waves labeled A, B, and C. A complete wave has eight cycles, which can be seen in the figure below.

A similar cycle occurs when the initial eight-wave pattern cycles as listed above. This process will then repeats itself over and over again.

This process happens in all elements of stock movement. It can be seen on a 50-year or a 10-minute chart the pattern is consistently developing.

For the Elliott wave principle to work correctly, data must be accurate and consistent across different periods. For this to happen, traders must use reliable tools such as moving averages or RSI readings to identify patterns and anticipate changes in price over time.

How to Use the Elliott Wave Principle

The Elliott Wave Principle is a tool that can be used to understand how markets work. It helps you see how market action waves can build up and eventually lead to a peak or bottom. The principle can also be used to predict future stock prices.

To use the Elliott Wave Principle in market analysis, you first need to understand its basics. This section covers the basics of waveform and how it can be used in financial markets.

Conclusion

The Elliott Wave Principle is a method of plotting out future stock movement. It can be used in market analysis to find trends, identify potential financial opportunities, and more. Using the principle in combination with other tools, you can better understand your surroundings and make informed decisions. To see how we use Elliott wave trading in real time with great success, sign up for your free account and get live updates at Option Strategies Insider.