It was just last week when I had an article published previewing a potential upcoming dividend raise for technology giant Microsoft (MSFT). Since the company had a history of boosting its quarterly payout in September, I figured it was just a matter of time before we got some news. On Wednesday afternoon, the company’s board delivered in a big way, announcing two items that shareholders will definitely appreciate.

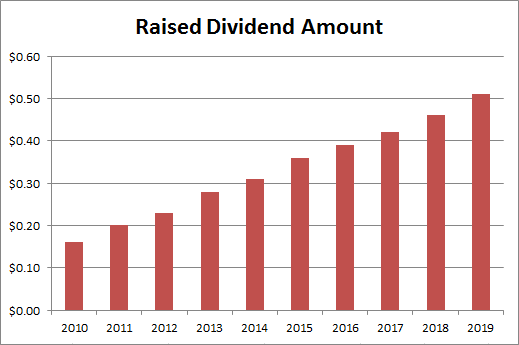

First detailed in this press release was the news regarding the dividend, which was increased by 5 cents per share a quarter. The new payout will be $0.51 a year, or $2.04 per year and is payable Dec. 12, 2019, to shareholders of record on Nov. 21, 2019. The ex-dividend date will be Nov. 20, 2019. In the chart below, you can see the company’s recent dividend history with the “2019” value being represented by the new payout amount.

(Source: Microsoft dividend history on Seeking Alpha, seen here)

It turns out that the new payout is exactly the middle of the range of what I predicted and represents an increase of just under 10.9% from the previous amount. This was the largest raise in terms of both cents and well as percentage in the past four years. Since 2010, the dividend has more than tripled from its $0.16 value, meaning, over that span, investors have seen compounded growth of roughly 13.75% a year.

The second part of Wednesday’s press release was that the board announced a new share repurchase plan of up to $40 billion. Like previous plans, there is no expiration date on this buyback, so it could happen over a couple years or many, depending on market factors. As of the end of the June quarter, there was still $11.4 billion left on the previous plan, so I guess we’ll have to wait for the next 10-Q filing or further clarification to see if this is new buyback authorization replaces the old one or is additional to it. As a point of reference, the company has spent roughly $42 billion on share repurchases during the past three fiscal years.

As I mentioned in my previous article, this strong capital return plan is being fueled by double-digit revenue and earnings growth, expected to continue for a couple of years. In the twelve-month period ending this June, free cash flow was more than $38 billion, up about $6 billion over the prior-year period. The company has a very strong balance sheet and larger profits moving forward should help cash flows even more.

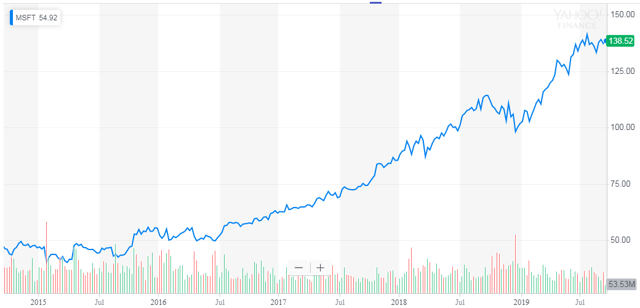

It certainly will be interesting to see how quickly management decides to spend that newfound repurchase authorization. While the average analyst target is still another 10% above current levels, the stock has been one of the best in the market in recent years as seen below. Shares in Wednesday’s after-hours session topped $140, putting them just a dollar or so from an all-time high. This stock hasn’t had many major pullbacks lately, but will management try to wait for one before really stepping in?

(Source: Yahoo Finance)

In the end, investors in Microsoft should be more than pleased with the news out on Wednesday afternoon. The company boosted its quarterly dividend by 5 cents as I figured it would, giving it a new yield of about 1.45% in after-hours trading. That might not seem like much, but in this low rate environment, when combined with a solid buyback, it provides a nice capital return plan. With the company already growing revenues and earnings nicely, this news might send shares to a new all-time high.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.