In June 2020, I started this small series with the goal to present a handful of stocks every month that one could invest in – even in times of sky-high valuations. You probably might have realized that I didn’t publish an article in August. Last month, I just could not find any good investment opportunities – aside from those already mentioned in the last two articles – so I decided to skip the month. In September the US stock market started a correction once again with the Dow Jones Industrial Average (DIA) being down 8.1% at the time of writing, the S&P 500 (SPY) has lost 7.9% and the Nasdaq-100 (QQQ) has lost 10.2% after an impressive run.

(Source: Pixabay)

In the following article, I will look at two stocks. Additionally, I will look at gold as an investment, but we start with a short look at the stock market in general.

Overall Stock Market

Stocks are not a good investment at this point – as I argued in my recent article “US Stock Market: It is a bubble, plain and simple.” The extreme valuation levels are making it difficult to find good long-term investments for reasonable prices. When investing over the really long run (several decades), we can buy high quality companies at this point and over the long run, it would still be a good investment. I showed this in my article “Lessons from history: 1966” by referring to the Nifty Fifty and the performance of some companies – like Walt Disney (DIS) for example – that were trading at extremely high valuations in 1972, but would still have been a great investment over the past five decades. However, it took about 13 years for Disney to reach the price levels of 1972 again and investors buying at the peak were facing a lost decade. And I assume that many investors right now will face a lost decade once again and many of the high-flying companies won’t reward shareholders over the next few years.

Shorting the market could therefore be an investment strategy at this point. However, I would be very cautious about shorting the market. Although the US stock market is clearly overvalued at this point, we can’t really be sure that a sentiment-driven market, which is not valuing stocks based on fundamental aspects, will stop here. I would assume that shorting the market at this point could be profitable over the next two or three years, but one might need strong nerves in the next few months (and liquidity as the market might stay longer irrational than you stay liquid).

Gold (GLD)

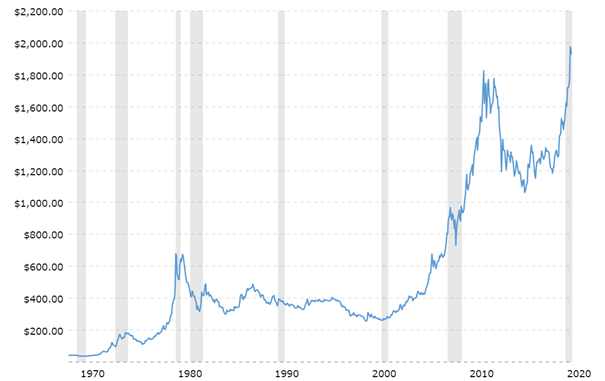

When trying to look at other asset classes and not just stocks, gold could be interesting once again. Over the last two years, gold as an investment performed in an impressive manner. Starting in August 2018, gold increased from about $1,160 to over $2,000, reflecting a gain of almost 80%. And considering the run gold had in the recent past, a correction of the last upward wave (beginning in March 2020) and also a correction of the bigger wave starting in August 2018 seem not only likely, but is already underway.

If gold is a good investment depends mostly on the question whether gold enters another “super-cycle.” Assuming we are at the beginning of the next major upward wave, gold probably has a long way to run. There are several targets out there – the most optimistic ones being as high as $10,000. And while this might sound insane, we have to put these numbers in context. When looking at the past two super-cycles we witnessed after the end of the Bretton Woods system in 1971, gold increased about 2,000% within one decade (between 1970 and 1980). Of course, we have to put these numbers in context and consider the extremely high inflation rates we witnessed during the late 1970s and early 1980s. But even inflation-adjusted, gold increased 800% in these years. During the next “super-cycle”, the gold price increased 630% between 2001 and 2011.

(Source: Macrotrends)

And when considering these numbers, a price target of $10,000 doesn’t seem so absurd any more. Of course, this is not a price target for the next few years, but maybe the end of the decade. Right now, we are in a correction and will probably see lower prices in the weeks and months to come. Last week gold broke out of the triangle it was forming towards the down-side and a correction to $1,700-1,750 seems realistic. This would mean a 50% correction of the last upward wave (Fibonacci levels) and the precious metal would also be supported by a rising 200-day moving average as well as the former highs from April and May 2020.

And over the long run, we have several bullish signs for a continuation of the current uptrend. The fear of inflation and the Fed “printing money” must be seen as a rather bullish sign for gold. Warren Buffett also bought stocks of Barrick Gold Corp. (GOLD) – and considering that Buffett has always been a vocal critic of gold, this is quite interesting and should also be seen as a bullish sign for gold. And when this latest gold rally started in August 2018, the Dow-to-gold ratio was also pretty high – about 22. When the last two super-cycles started, the ratio was similar. In 1970, the Dow-to-gold ratio was about 24, in 2001 it was even 40. And there is another similarity, which can be seen as bullish for gold. Both timeframes – the years between 1970 and 1980 and the years between 2001 and 2011 – were two decades, in which the stock market basically moved nowhere or where we saw major stock market corrections, while the gold price increased in an impressive manner. And although many don’t believe it – the next decade will be similar.

One major risk, which remains and makes gold a dangerous investment, is the fact that it is impossible to calculate an intrinsic value for gold. It has no utility as Warren Buffett always pointed out (which is probably the reason why Buffett invests in a gold miner and not gold itself) and it is hard to argue if $2,000 or rather $200 should be a fair value for gold.

When trying to find stocks one can invest in right now, this is a difficult task – as I pointed out above. In the last few weeks, I wrote several articles about different banks from the United States, Canada and Sweden. The conclusion was more or less the same for all banks I covered so far: when seeing banks as long-term investment (over the next few decades), bank stocks are cheap and might outperform in an impressive way, but over the short-to-medium term I expect bank stocks to decline further and get even cheaper.

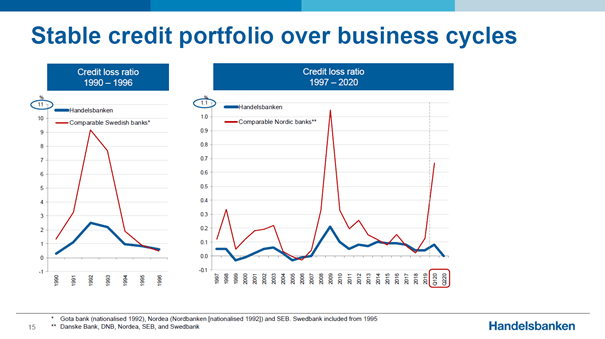

I still wouldn’t invest in banking stocks in a major way, but there might be one exception and a stock I actually bought last week – Svenska Handelsbanken. First of all, Handelsbanken is trading for a P/E ratio below 9 and although most banks are trading at such low ratios, a single-digit P/E ratio is cheap. It is especially cheap for a company that has a wide economic moat around its business – and despite all the challenges banks are facing (and have been facing during the last decade), the economic moat is still in place. These arguments are also true for many other banks. What makes Handelsbanken so different is its extremely risk-averse nature. This makes a collapse or serious troubles rather unlikely. This is visible in the extremely low credit loss ratio of Handelsbanken, which was actually 0.00 in the second quarter of 2020. The Swedish bank also managed to get through the Financial Crisis of 2008/2009 pretty well.

(Source: Svenska Handelsbanken Investor Presentation)

Assuming a similar performance this time, I also consider an extremely steep drop (70-80%) for the stock price unlikely and Handelsbanken is already trading 45% below its former high (which was set in March 2015). During the Financial Crisis the stock declined 63%, but we don’t know if this drop will be similarly steep. And between SEK 70 and SEK 80 we have several highs from the years before and after the Financial Crisis, which are providing a strong support level. And when assuming that management will stick to its original proposal of SEK 5.50, the dividend yield would be above 7% (but it might also be the case that there won’t be a dividend in 2020).

In the last two weeks, Svenska Handelsbanken dropped about 10% due to two reasons. On September 15, 2020, it was announced that Handelsbanken UK changed its methodology at group level for calculating capital requirement for credit risk. A day later, on September 16, 2020, the bank announced a change in its strategy, which is much more important. Handelsbanken was always focused on its branches and the “church spire principle” was basically demanding that every branch manager should be able to see all the customers from the steeple. But now the bank announced that the number of branches in Sweden will decrease from about 380 to approximately 200 by the end of 2021. The bank will also cut about 1,000 jobs. But on the other hand, the bank is continuing to invest in its digital customer offerings (a total amount of SEK 1 billion over the next two years).

The focus on its branches was Handelsbanken’s unique selling point and this strategic change might result in the loss of some customers that chose Handelsbanken due to its dense branch network. But on the other hand, to which bank should they switch – Handelsbanken still has the densest network of all banks in Sweden. And if the branch manager doesn’t know every customer personally, this does not mean that Handelsbanken can’t be a risk-averse business anymore. And digitalization is extremely important for every bank. As Sweden is a country which is extremely open for cashless payments and at an advanced stage regarding digitalization, I assume the Swedish customers will learn to live with that decision. Hence, I would assume that some Swedish customers of Handelsbanken might not be pleased right now but it won’t be a huge problem over the long run. Fitch is also affirming its ‘AA’ rating, but changed the outlook to negative.

Simon Property Group (SPG)

Aside from banks, there is another category of stocks that is usually paying a high dividend yield, but which didn’t receive any attention from myself – the category of real estate investment trusts (REIT). As these stocks have been hit hard by the pandemic, we might look at potential bargains. In this article I will take a quick look at Simon Property Group, which already declined in the years before the pandemic. The stock hit its highs already in 2016 and in the following years, the stock was trading already about 25% lower. And in March 2020, the stock tanked and is still trading more than 70% below its previous all-time highs.

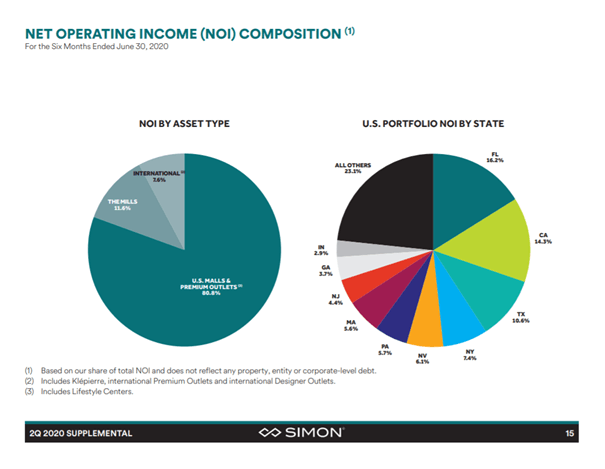

Simon Property Group is the largest shopping mall operator in the United States. As of December 31, 2019, the group held an interest in 204 income-producing properties in the United States (106 malls, 69 premium outlets, 14 mills, four lifestyle centers and 11 other retail properties). Internationally, the group had ownership interests in 29 premium outlets and designer outlets – primarily located in Asia, Europe and Canada.

(Source: Simon Property Group Supplemental Information)

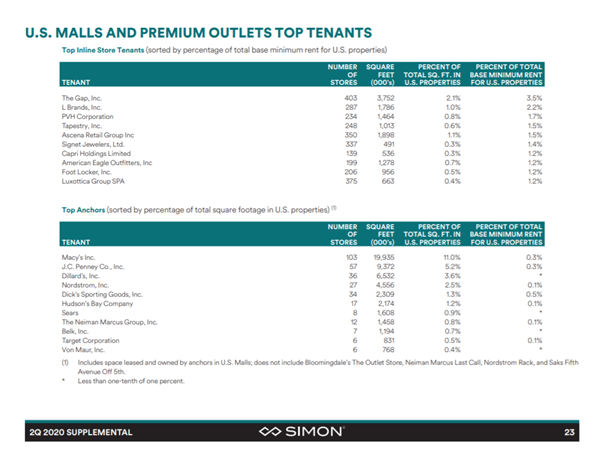

The difficult task right now is to assess what will happen in the months and years to come. Simon Property Group is certainly facing a high level of uncertainty. Although several heads of state claimed that another lockdown will be out of question, malls could face the negative consequences of a second wave – people staying at home either by themselves or because malls and stores closed by the owners or because it is ordered by the government. Additionally, bankruptcies of several retailers can also become a problem. If smaller retailers go bankrupt in the coming quarters, these companies won’t be able to pay rent to SPG which will result in lower revenue for the group.

(Source: Simon Property Group Supplemental Information)

When looking at the second quarter, revenue decreased 24.0% while earnings per share decreased from $1.60 to $0.83. The diluted (and basic) FFO per share was $2.12 for the quarter. When assuming the past quarter was among the worst what Simon Property Group will face, we should be optimistic as the dividend seems to be safe and Simon Property Group was still profitable. Another horrible quarter or maybe two horrible quarters during the fall and winter won’t be great for shareholders and the business, but even another lockdown seems manageable for Simon Property Group.

Of course, the REIT is especially interesting for its dividend. In the last quarter, Simon Property Group paid a dividend of $1.30 and although the dividend was cut from $2.10 in the previous quarter, this is still resulting in a dividend yield of 8.2% for investors.

Conclusion

I still find it extremely difficult to identify bargains in the current market environment that fulfill my criteria of stable and predictable business models with a (wide) economic moat around the business. We can also identify several stocks that declined pretty steep since the beginning of September. However, the stocks that declined pretty steep – like Apple (AAPL), which declined 20% or Tesla (TSLA), which declined 30% – are stocks that were so extremely overvalued that even a 30% decline does not make these stocks fairly valued. And while many might see this dip already as a good buying opportunity, the market is still trading at extremely high valuation multiples.

Disclosure: I am/we are long SVNLF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I own gold in physical form, I am short the Nasdaq-100 using derivatives.