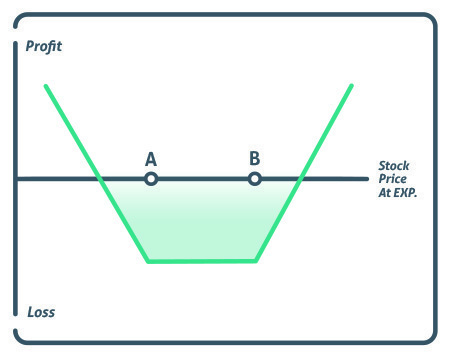

The long strangle (buying the strangle) is a neutral options strategy with limited risk and unlimited profit potential. It is performed by buying a lower strike price put, represented by point A, and buying a higher strike price call, represented by point B. The strategy is best used in highly volatile markets where a significant price move in the stock is expected, but unsure of the direction of the large move. Such scenarios might include company earnings or big announcement.

When implementing a long strangle, the investor only cares about how far the stock will travel and will profit with a large move in either direction. If the stock trades up, the investor can let the put option expire worthless and exercise the call. If the stock trades down, the investor will let the call expire worthless and exercise the put. The profit potential is unlimited, while the risk is limited to the net premium paid in this strategy. The maximum loss is reached when the stock price falls between point A and point B on expiration.

Risk vs. Reward

A trader who enters the long strangle options strategy is banking on significant movement in the stock, either upwards or downwards, by the expiration date. If the stock trades up, there is no limit to how far it can go and how much profit can be made. If the stock trades down, the trader can make profits all the way down to zero.

Traders have limited risk when executing a long strangle options strategy as they are capped by the premium paid to enter the trade. However, if the stock price hasn’t broken through the strike price on either the call side or the put side by the expiration date, the trader will lose his entire investment, rendering both options worthless.

New traders are often attracted to the long strangle option strategy due to the possibility of massive gains accompanied by limited risk. However, the long strangle option strategy comes with a very low probability of success as a trader must pay two premiums, both on the call side and the put side, and then expect the stock movement after the position is entered to travel far enough to account for both premiums paid.

Profit/Loss

The maximum profit for a long strangle strategy is unlimited as the position can continue to pick up gains the further the stock travels in either direction.

Maximum Loss = Net Premium Paid

Breakeven

A strangle has two breakeven points.

Lower Breakeven = Strike Price of Put – Net Premium

Upper Breakeven = Strike Price of Call + Net Premium

Example

If the stock is trading at $50 and one is expecting the stock to either increase or decrease in the near future, an investor can simultaneously purchase $55 call and $45 put for the net cost premium of $4.

If the stocks were to increase to $65 upon expiration, then the $55 call would be worth $10, less the $4 premium, resulting in a profit of $6. Otherwise, if the stock were to drop to $35 upon expiration, then the $45 put would similarly be worth $10 resulting in the same $6 after deducing the premium paid.

If the stock stayed between the two strike prices, 45 and 55, then the trader would lose their $4 investment.

Conclusion

The long strangle has a long call and a long put, thus, time decay works against the buyer of this strategy. Unlike the short strangle which benefits from time decay, the long strangle loses value day after day and will require the stock to breakout in one direction to stay profitable.

This option trading strategy has unlimited profit potential in a volatile market while minimizing the loss. The investor need not worry about the direction of the price movement and will benefit from an increase in volatility.

The price change of the stock has to be significant to profit.