The covered call strategy involves the trader writing a call option against stock they’re purchasing or already hold. Besides earning a premium for the sale, with covered calls, the holder also gets access to the benefits of owning the underlying asset all the way up to the strike price, where the stock would get called away.

There are many different uses of the covered call strategy. Some use the strategy to make additional profits to the stock they hold while markets trade relatively flat. This is popular option strategy among traders, because, besides the premium, investors can benefit from capital gains should the underlying asset increase in value. Out of the money (OTM) call trades are placed when the outlook is neutral to bullish.

The Beauty of the Covered Call Video

When to Use the Covered Call

The covered call strategy is usually opened with 30 to 60 days before expiration. This allows a trader to benefit from time decay. Of course, the optimum time for implementing the strategy depends on the investors goals. If the goal is to sell calls and make money on the stock, then it’s best if there isn’t a lot of difference between the stock price and the strike price. If the goal is to sell the stock and the call, then you should be in a position where the calls will be assigned. For this to happen, the stock price will need to stay above the strike price until expiration.

Some investors sell calls and purchase stocks at the same time. This strategy is called a buy-write, and it’s used to decrease the cost basis of recently purchased stocks. With cover calls, there is no additional margin requirements on the stock as you own it. A suitable premium when selling the call is 2% of the current stock price (the premium divided by the stock price). You should calculate how you can gain from the strategy and set a premium accordingly. Investors will receive a higher premium when shorting options if implied volatility is high. For this reason, many investors like holding the stock, and then sell call options with a high premium to help cushion the risk of loss from a downward movement in the stock

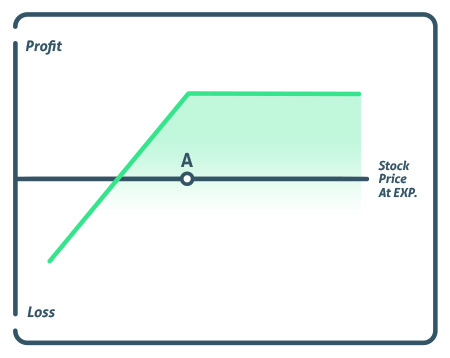

Profit/Loss

The maximum profit with this strategy is the difference between the strike price and the current stock, plus the premium received for selling the call options contract. Beware of the pitfalls of this strategy, though. The potential loss of this strategy can be substantial.

This loss happens when the price of the underlying asset decreases. However, unlike stock trading, the downside is slightly less painful due to the premium received, that will cushion any downside stock movement.

Breakeven

The breakeven point is the difference between the current stock price and the premium received for selling call options.

Example

To understand OTM calls, let’s considered the following example: A trader buys 100 shares of stock at $20 in May and writes a June 25 OTM call for $2. If at the expiration of the option, the price of the stock is $28, the strike price of $25 is lower than the stock price. As a result, the call is assigned, and the writer sells the shares at $25. Here the trader would have made $5 on the stock movement, plus $2 on the calls, for a total profits of $7.

What if the stock price had gone down instead of up? In this case, the writer will have a loss on the stock, but a profit on the calls as they will expire worthless. If the stock traded down to $17, the trader would have lost $3 on the stock, but because they sold calls for $2, their net loss would only be $1.

Conclusion

Covered calls are a great way to generate additional income from owning stock and suitable for investors with all skill levels.