Introduction: A Financial Model

Financial models are an indispensable part of every company’s finance toolkit. They are spreadsheets that detail the historical financial data of a given business, forecast its future financial performance, and assess its risks and returns profile. Financial models are typically structured around the three financial statements of accounting — namely: income statement, balance sheet, and cash flow statement. The management of most corporations rely, at least in part, on the details, assumptions, and outputs of financial models, all of which are critical to said companies’ strategic and capital decision-making processes.

This article serves as a step-by-step guide for the novice and intermediate finance professional looking to follow expert best-practices when building financial models. For the advanced financial modeler, this article will also showcase a selection of expert-level tips and hacks to optimize time, output, and modeling effectiveness. Let’s begin.

Planning Your Model

As with all things complex, the first step to building a financial model (“model”) is to carefully layout a blueprint. Unplanned, unanticipated structural changes midway through a modeling exercise can be time-consuming, confusing, and error-prone, especially if the model’s adapter is not the same as its author. Such challenges are easily subverted with a bit of devoted planning time at the onset of the exercise. I recommend that your planning phase go as follows:

1. Define the model’s end goal.

Clearly defining the purpose of a model is key to determining its optimal layout, structure, and end-outputs. As part of this process, take the time to ensure that your model’s key stakeholders sign off on your blueprint and process design before starting to build. This gives them the opportunity to voice any final preferences or intentions, thus avoiding any “scope creep” (industry parlance) or painful redirection down the road.

2. Understand the timelines for both building the model and for its useful life.

Though secondary to the model’s end goal, understanding the timelines for building the model and how long the model will be used for are also important inputs to determining the approach to the modeling exercise. Long-duration and long-tenured (useful-life) models are typically custom built from the ground up and include tremendous amounts of operating detail, flexibility, and sensitivity capabilities. For more immediate, shorter duration operating or capital-project models, modelers will oftentimes use prefabricated templates to maximize speed of construction while minimizing errors. Further, model templates also tend to be more familiar and thus easier to use/manipulate by different stakeholders within organizations.

3. Determine optimal trade-off between “detail” vs. “reusability.”

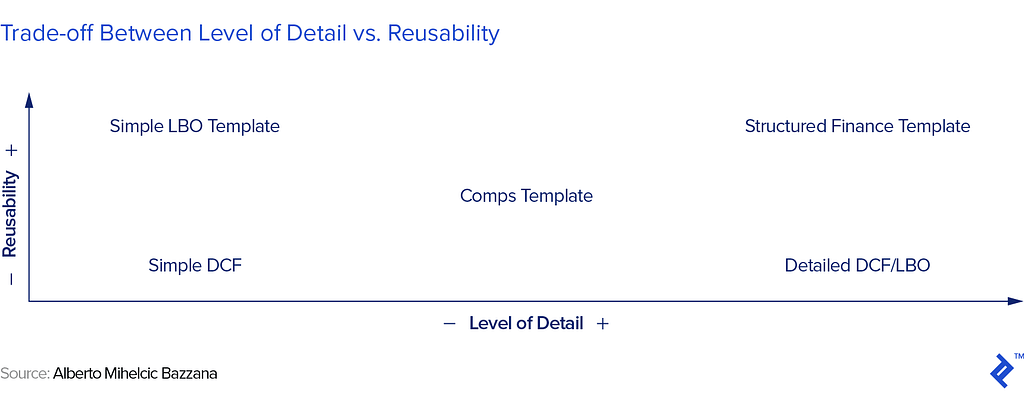

When deciding the optimal trade-off between desired level of detail and model reusability (i.e., whether the model is intended to be re-worked for multiple transaction-types/purposes or has instead been designed for just this one-off exercise), a useful framework for deciding on one’s model choice/approach, which I have followed through most of my career, is as follows:

With the blueprint/planning phase now complete and key decisions settled up, we may now move onto the next phase of modeling.

Structuring Your Model

At this juncture, we are ready to open Excel and to begin thinking about structuring. At the highest possible level, every model can/should be divided into three sections: (a) inputs/drivers, (b) calculations (projected financial statements), and (c ) outputs. The better one is at segregating these sections, the easier it will be to audit and amend the model while minimizing errors and optimizing on time.

I have followed the same structural approach for almost every model that I have built; an approach which both my respective stakeholders and I have always found practical, digestible, and ultimately useful…

Interested in getting to the heart of our expert-level tips, hacks and financial modeling best practices? Read the full article here.

Advanced Financial Modeling Best Practices: Hacks for Intelligent, Error-Free Modeling was originally published in Toptal Publications on Medium, where people are continuing the conversation by highlighting and responding to this story.