In 2020, we have had a couple of things transpire which nobody expected:

First, a pandemic with a major market crash.

Second, a V-shaped stock market recovery.

When the first event happened, I told myself “oh well, this won’t be a good year for my portfolio” and expected to end 2020 in red territory. The year is not over yet (and we all know how 2 months could make a difference!), but so far, my portfolio is still showing some profit. We had what nobody thought would be possible as a V-shaped stock market recovery evolved this year.

However, while the S&P 500 has fully recovered from the March market drop off, most investors see it more like a K-shaped recovery in their portfolio. This means some sectors thrived (tech, consumers, and healthcare) while other sectors kept going lower (energy, financials, and some REITs). Many investors hold stocks from the first group of sectors with great pride as they save their portfolios. Some others are holding onto their losers, hoping they will eventually show some signs of life. Last week, I wrote about 3 companies that bear false hope as they will continue to be dead money for many years.

This week, we go on a lighter note and discuss companies that took a beating (more than a 20% drop since Jan. 2020), but they are ready to hop in the ring for a second round. Here are four of my favorite picks from among the pandemic losers.

Apogee Enterprises will break its glass ceiling

Apogee Enterprises (NASDAQ:APOG) is a manufacturer of architectural glass and metal glass framings. Its four main business segments are Architectural Framing Systems (49% of sales), Architectural Glass (25%), Architectural Services (26%), and Large-Scale Optical Technologies (LSO)(6%).

APOG is not your classic window maker for your bungalow but rather a high-quality business getting contracts for skyscrapers, commercial centers, universities and luxury family homes. The company generates most of its revenue in the U.S. and in Canada while expanding (modestly) in Brazil.

Why APOG has lost 23% of its value since January?

When you think of tall building constructions, you may think of office towers and other commercial properties. With the pandemic promoting ongoing fears of future partial or total lockdowns, we can readily imagine how future office towers and commercial projects may be put back on the shelf for a few years. Therefore, we can expect APOG revenues to slow down in the coming year.

It is no surprise that the APOG business model is highly cyclical. If no new buildings are being built, APOG won’t sell much framing and glass. When you look at APOG revenue trends over the past 2 years, you can see the business was slowing down before COVID-19. While APOG is down 23% this year, keep in mind it was trading around $60 back in 2017. This small cap has taken a continuous beating on the market for the past three years.

How it will come back and make you richer

First, the picture is not as gloomy as it might seem. From their Q3 2020 presentation, Apogee management is confident their business will bounce back rapidly. Their confidence is not just smoke and mirrors as they base their projections on a solid sales backlog for 2021.

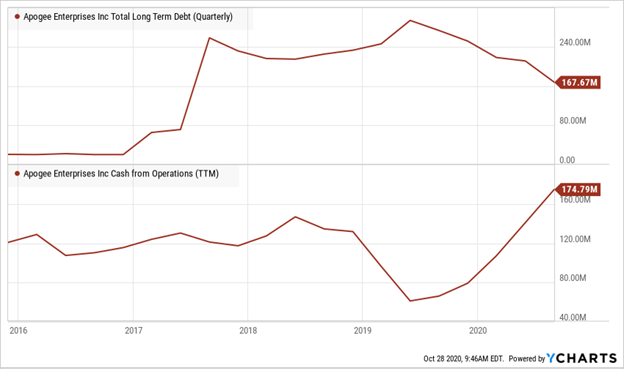

With the number of prestigious contracts they have been awarded in the past, Apogee’s reputation is rock solid. They will be part of many important projects in the future. It’s only a matter of time before the construction industry needs their services. In the meantime, management has made sure to improve cash-flow generation while paying down debt. As we may get stuck in a long recession, you want to be invested in companies with a solid balance sheet.

Make yourself comfortable with Essex in your portfolio

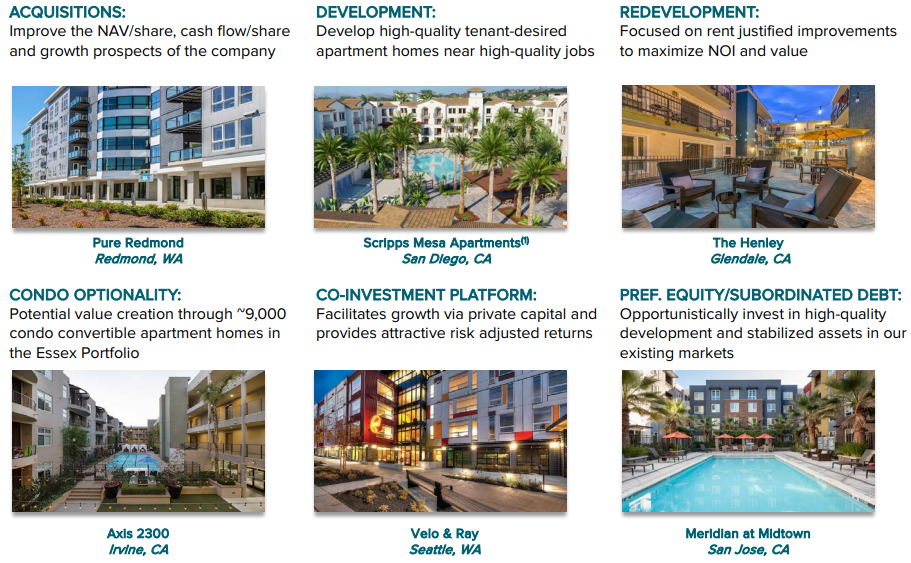

I recently discussed Essex Property Trust (ESS) in this article. Essex has caught the attention of many dividend investors at Seeking Alpha as it is a rare REIT that could claim to be part of the dividend aristocrats. Essex Property Trust owns a portfolio of 250 apartment communities with over 60,000 units and is developing seven additional properties with 1,960 units.

Source: ESS September investor presentation

This REIT specializes in high-quality, multi-family properties situated mostly in California and in Seattle. Their business is quite simple: they target professionals (working in the tech industry) that would rather enjoy life instead of taking care of household chores.

Why ESS lost 37% since January?

It has been a rough ride for Essex since the beginning of the year. The REIT was trading at over $300/share not too long ago and seemed to have a bright future. Today, demand for apartments has plummeted while the supply kept rising. The problem with large apartment projects is that you just can’t stop new construction and pretend it never happened. There are contracts in place to invest money. REITs must complete their new apartment buildings whether the demand is there or not at the time of completion.

When demand is weak, the war for quality tenants is on. Landlords will forfeit rent increases in order to keep their existing tenants. They may also offer lower rental rates or spend more on promotion to attract new tenants. All these actions may fill their apartment books, but it will be done at the possible expense of profitability. The market currently expects apartment REITs (like ESS, AVB, and EQR) to struggle for a while.

How it will come back and make you richer

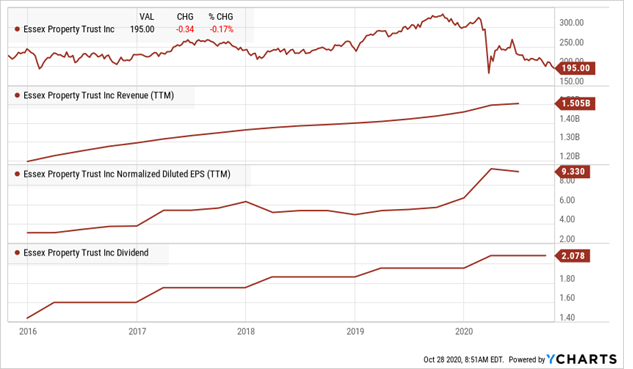

If you look at the entire sub-sector of apartment REITs, you will find that most of them are struggling this year. Why did I pick ESS as my example of this market? First, Essex is a dividend aristocrat. This means it knows how to go through a crisis and continue to reward shareholders. Second, Essex is strategically situated in cities where employment will likely thrive in the future. While many sectors are affected by the pandemic, tech hubs like California and Seattle will see continued economic growth. It was already an ongoing trend before the virus hit, and we now need technology more than ever.

Essex Property Trust is everything a successful REIT should be. They have a dominant position in a rich market, a decent yield, and a stellar dividend growth history. Most income-seeking investors are looking at REITs with poor growth vectors and high dividend yield. If you are willing to go under the 4% yield level initially, you will find this beauty to be a worthwhile long term holding.

V.F. Corporation will make your investments look cool

The company who used to make only mittens more than 100 years ago has transformed itself into a major apparel & accessories brand manager. V.F. Corporation (NYSE:VFC) designs, produces, and distributes branded apparel and accessories. Its largest apparel categories include action sports, outdoor, and workwear. Its portfolio of about 20 brands includes Vans, The North Face, Timberland, and Dickies.

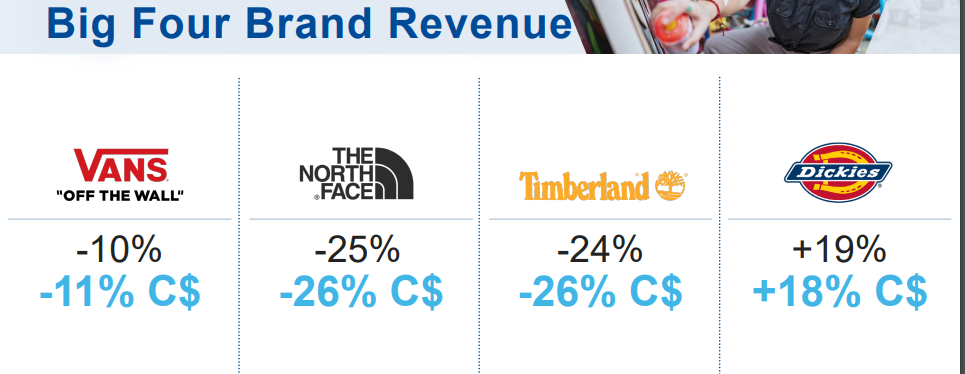

Source: VFC Q2 presentation

VFC has built a solid expertise in buying established brands, making them more popular and cashing in on those investments. In 2019, they spun off their jeans brands (Lee and Wrangler) under Kontoor Brands (KTB).

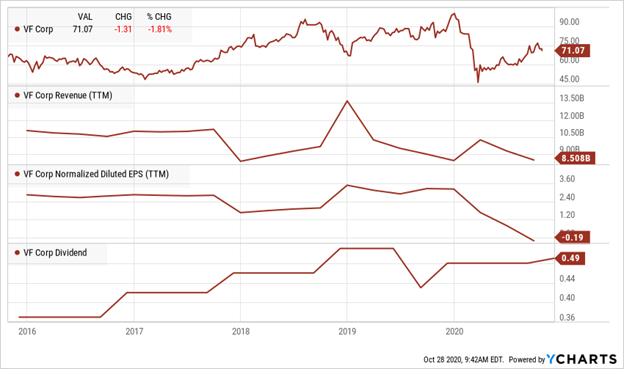

Why VFC has lost 29% of its value since January?

VFC traded at close to $100/share in early 2020 right before the pandemic. Then, it missed financial analysts’ estimates for the first quarter. Investors feared a slowdown in the apparel industry before the real storm happened with a full economic lockdown. Most of their clothes are sold through brick-and-mortar retailers; so with stores closed, sales plummeted, Q2 FY2021 was down by 18%.

As cases are spreading and more lockdowns (partial or total) are expected this winter, VFC will not thrive in this environment. They are working on their digital sales (+44% last quarter), but it’s too little too late to keep VFC’s nose above the water line.

How it will come back and make you richer

Those who follow my monthly dividend income update know I bought VFC during the crisis. I was happy to sell a few shares of Apple (AAPL) to rebalance my portfolio and buy an underappreciated asset. It has been a bumpy ride since, but there has been some momentum since August.

VFC is a long-term play as I don’t expect sales to surge in 2021. However, I expect reputable brands such as Vans, The North Face, Timberland and Dickies to be around once the pandemic is over. VFC has become a master in acquiring brands and making them better. While many look at sales plummeting, I see an amazing opportunity for VFC to acquire more brands in difficulty. This could become a turning point for the company. VFC is currently looking at selling its working wear brands to bring more cash into the business and then make more acquisitions.

The final indicator that rarely lies: VFC recently bumped its dividend by 2% in October. This bold action shows strong confidence by the management in VFC’s future. I’m happy to be on board with this one!

A last one for my fellow Canadians: How CAE will teach you how to fly your portfolio

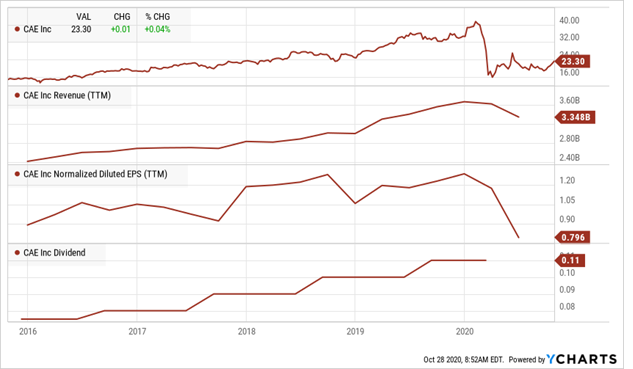

I wanted to end this article with a thought for my Canadian readers. However, CAE (CAE) trades on both sides of the border (TSE and NYSE), and therefore offers an excellent opportunity for all my readers.

The company is an international leader in training for the civil aviation, defense, security, and healthcare markets. This may be a first: a company that not only cut its dividend, but also went on to suspend it completely is now part of a “buy list” from the “dividend” guy.

CAE suspended its dividend and its share buyback plan on top of laying off 2,600 of its 10,500 employees. The company shows about 50% of its revenue coming from civil aviation training. You can imagine that the next few quarters will likely not include any good news. The demand for both pilot training and for new simulator time has and will continue to plummet.

The stock price dropped by more than 33% this year after a long bullish ride. In fact, you would still be making lots of money (more than 50%) if you had purchased CAE 5 years ago. This is because the company was surfing the bullish trends surrounding the aerospace industry until the pandemic struck. I recently bought more of this one as I see how CAE can spin its business around and come back stronger than ever.

First, CAE is a highly innovative company. While the company faced an important challenge, it quickly shifted some of its resources to offer healthcare training support regarding the COVID-19 pandemic. It also signed a contract with the Canadian government to manufacture 10,000 ventilators. I don’t think CAE will become a major player in the ventilators industry, but it shows you how the corporation can use its impressive engineering brain power to move forward.

Sooner or later, the airlines will reopen and the demand for recurring pilot training will resume. Management mentions there is already a shift in pilot training as many of them are returning to work to fly different airplane types. Training is mandatory and it is always evolving in the aerospace industry.

Finally, CAE can also count on its defense segment (about 40% of revenue) and healthcare to generate a constant flow of income in the meantime. There is a great opportunity to increase their product offerings in healthcare training amid the virus. I have no doubt the company will survive this crisis and will eventually resume its dividend.

Final Thought

As the market is clearly in a K-shaped recovery, investors taking a chance in struggling industries will have to remain patient. I don’t expect those picks to thrive in the coming months. It will likely take a good 12 to 18 months for these corporations to rise from their ashes and generate some interesting returns.

VFC and CAE are likely going to generate significant stock appreciation once they are back on a roll. For retirees or those who prefer more stability, I’d go with Essex as the dividend is safe and the yield is good. Tell me, which losers you think will soar in the coming years?

Many investors focus on dividend yield or dividend history. I respectfully think they’re making a mistake. While both metrics are important, aiming at companies that have and show the ability to continue raising their dividend by high single-digit to double-digit numbers will make your portfolio outperform others. When a company pushes its dividend so fast, it’s because it is also growing its revenues and earnings. Isn’t this the fundamental of investing – finding strong companies that will grow? If you are looking for a great combination of dividend and growth, check out Dividend Growth Rocks.

Disclosure: I am/we are long CAE, VFC, AAPL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.