REIT Rankings: Apartments

In our REIT Rankings series, we analyze REITs within each of the commercial and residential sectors, focusing on property-level fundamentals and the macroeconomic forces driving overall supply and demand conditions. We then analyze REITs based on both common and unique valuation metrics, presenting investors with numerous options that fit their own investing style and risk/return objectives.

This article was co-produced with Brad Thomas through iREIT on Alpha.

Apartment REIT Sector Overview

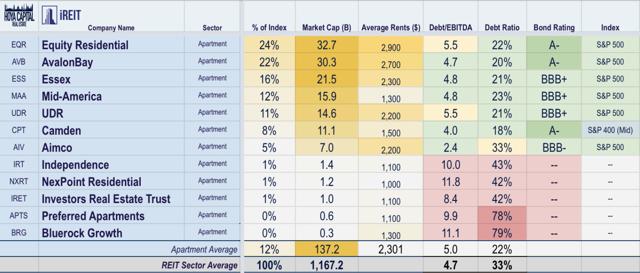

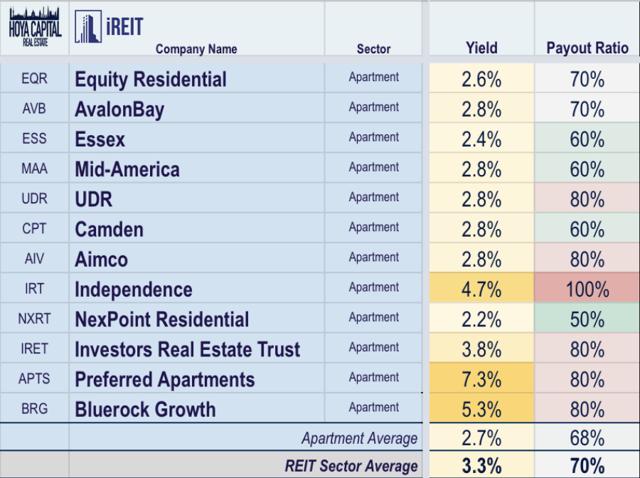

Within the Hoya Capital Apartment REIT Index, we track the twelve largest apartment REITs, which account for roughly $140 billion in market value and more than 500,000 total housing units: Equity Residential (EQR), AvalonBay (AVB), Essex (ESS), Mid-America (MAA), UDR (UDR), Camden (CPT), Aimco (AIV), Independence Realty (IRT), NexPoint (NXRT), Investors Real Estate (IRET), Preferred Apartment (APTS), and Bluerock Residential Growth (BRG). Apartment REITs comprise roughly 10-14% of the broad-based REIT ETFs (IYR and VNQ).

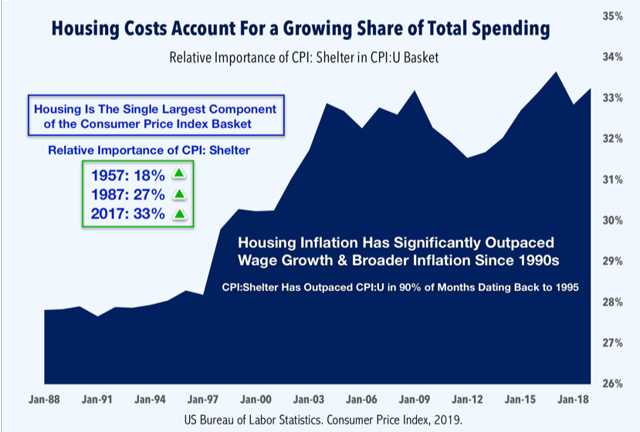

Apartment REITs also comprise roughly 10% of the Hoya Capital Housing 100 Index, the housing industry benchmark that tracks the GDP-weighted performance of the US housing sector. Americans spend an estimated $1.3 trillion per year in direct and imputed rent, accounting for roughly 30% of the $3.5 trillion per year spent on an annual basis on housing, home construction, and housing-related services at the GDP level. Housing is the single-largest annual expenditure category for the average American at roughly 33% as measured by the Bureau of Labor Statistics.

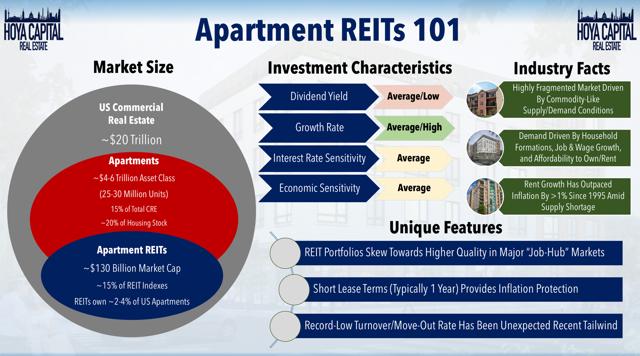

The $4-5 trillion US multifamily apartment market is highly fragmented, with REITs owning roughly 500,000 of the estimated 25 million multifamily rental units across the US, which is roughly 2% of the existing rental apartment stock. Multifamily rentals comprise roughly 15% of the total housing stock in the US – in aggregate valued at $30 trillion – but have accounted for a greater share of new home construction activity in the post-recession period. Apartment REIT portfolios are skewed towards the upper end of the rent spectrum, making them less exposed to the direct effects of rent control, but many of the larger REITs do focus on coastal markets that are more at-risk of an unfriendly regulatory environment for real estate owners.

“Rent Control.” The dirtiest words in real estate became a focus during 3Q19 earnings after Oregon and California became the first states to enact state-wide rent control laws this year. Despite overwhelming economic evidence, including the consensus of 95% of economists, that rent control laws do more harm than good for renters, the policy that has been called the “bad idea that doesn’t go away” has made a political comeback this decade.

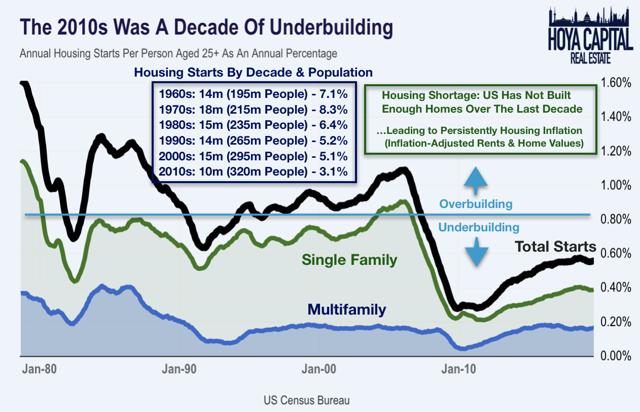

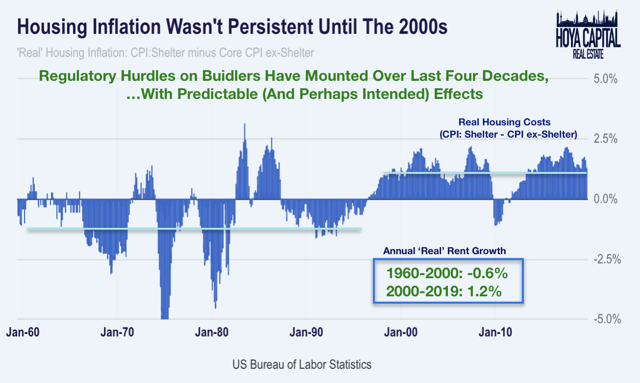

Undersupply of housing has been the driving force behind rising housing costs, and as we’ll discuss in greater detail below, over-regulation at the local, state, and national levels has been at the root of the growing housing shortage, which has led to persistent housing inflation. The regulatory cost and timeline of constructing new housing units have substantially increased over the last two decades, and we continue to believe that easing impediments to supply growth is the optimal policy method to reduce housing cost burdens over time.

Through the lens of an economist, apartment markets are as close to a “perfectly competitive” market as there can be. With rather homogeneous product offerings and efficient access to information (thanks to Zillow (Z) and others), apartment owners are “price-takers” rather than “price-makers.” Rental fundamentals respond in a rather efficient and predictable way to supply and demand conditions, highlighted by the minimal differentials in operating performance exhibited by the seven major REITs.

Over time, markets seeing well-above-trend rental growth experience a subsequent period of elevated new development, and vice-versa, but the market-based supply response can be interrupted and skewed by price ceilings or other regulatory actions. Economists including Dartmouth’s William Fischel have explored how zoning laws have, over time, departed from the “good-housekeeping” model towards a model of “growth control” (often using environmental or social justifications as a means to block new development), which we think explains much of the recent phenomenon of higher ‘real’ housing costs over the last two decades.

Again, while rent control and overly restrictive zoning regulations are certainly bad news for renters, we see a fairly minimal near-term (and perhaps net positive) impact to these apartment REITs that tend to be skewed towards the “luxury” renters. The high-end has actually been among the few housing segments seeing amply supply growth over the last decade, and naturally, rent growth has been relatively more modest (and below the projected rent control caps) than in the affordable housing segments.

From an investment perspective, apartment demand is driven primarily by demographics, employment growth, and wage growth. Apartment REITs tend to pay relatively modest dividend yields compared to other REIT sectors but are seen as somewhat counter-cyclical while also providing inflation protection due to the short lease terms of multifamily rental units. Over the last decade, apartment REITs have become far more active developers and have been able to create significant shareholder value through “capital recycling,” a strategy of selling assets of lesser strategic value to fund development and acquisitions of higher-value properties.

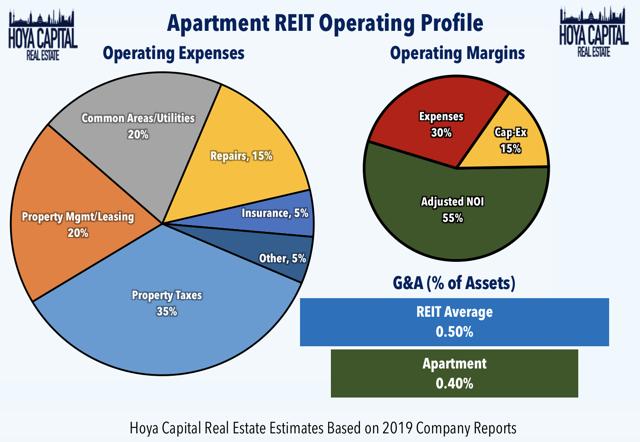

A common feature among residential real estate sectors, apartment REITs are among the most operationally “efficient” real estate sectors, commanding a relatively low operating and overhead expense profile and requiring fairly minimal ongoing capital expenditures. Property tax is the largest single expense item for apartment owners and is one of the few line items expected to see consistent above-inflation growth over the next decade. As we’ll discuss more below, apartment REITs have benefited from extremely favorable millennial-led demographic trends over the last decade, but we anticipate that demographics will become a mild headwind in the 2020s.

Apartment REIT Fundamentals

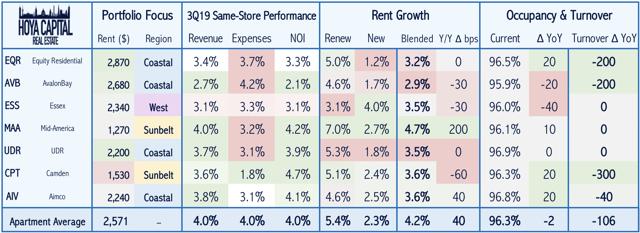

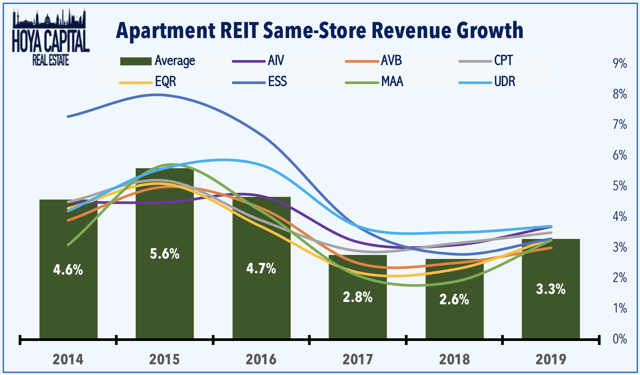

It’s a pretty good time to be a landlord yet again. As we’ve been forecasting since late 2018, after a slowdown in operating metrics over the preceding two years, the apartment REITs have delivered impressive performance through the first half of 2019. Same-store operating metrics were stellar across the board as occupancy remained at record-highs, turnover at record-lows, and rent growth accelerating to the best rate of growth since 2016. Leasing metrics – arguably the most important of the statistics reported – were better-than-expected, with blended lease rates seeing a 4.2% bump, a roughly 40 basis point improvement over the same period in 2018.

Expense growth outpaced revenue growth in 2018 but has shown significant improvement in the first half of 2019, helping to power same-store NOI growth to the best level in roughly three years at roughly 4.0%. Ever-lower turnover rates continue to be an unexpected but much-welcomed tailwind which has kept expense growth in check. A relatively benign season of extreme weather and lower utility costs helped to offset the continued rise in property taxes – the largest single expense item for apartment REITs. Property taxes continue to be a chief concern among investors, particularly in the wake of tax reform, which shifted more tax burden onto homeowners in high-tax coastal markets, which could eventually be shifted back onto renters.

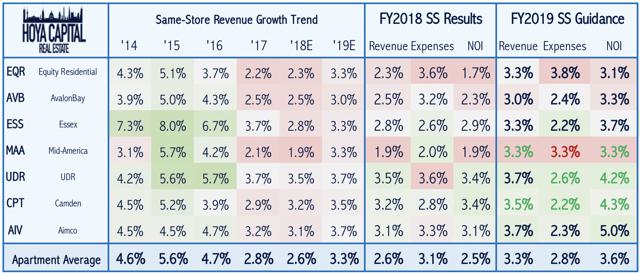

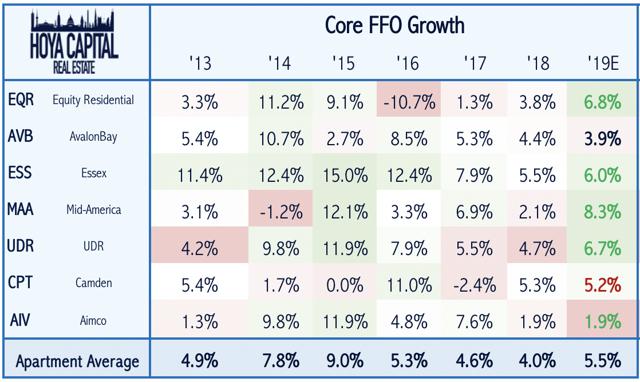

Three of the seven major apartment REITs raised 2019 same-store net operating income guidance in the third quarter while five of the seven raised core FFO guidance. As rent growth is a forward indicator of same-store revenue growth, we expect a further reacceleration in same-store revenues into next year. That said, just as the surge in mortgage rates last year powered incremental demand into the rental markets, we expect that the substantial drop in mortgage rates over the last year will push some marginal households into the ownership markets. While we expect to see a similarly solid year of rent growth in 2020 powered by real income growth, we think that the recent upward momentum to rent growth is waning.

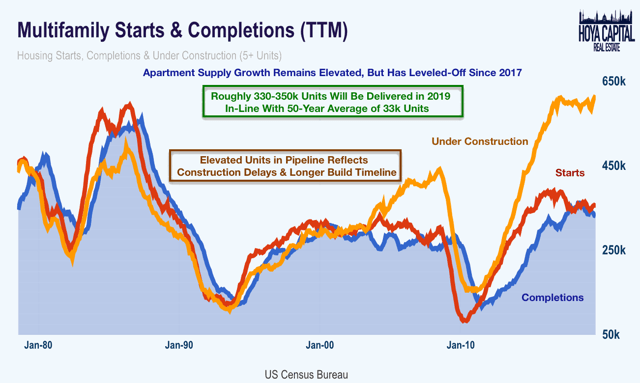

Supply growth also remains a headwind for the apartment REIT sector. Before this year, renters enjoyed a brief reprieve from rising rents over the prior two years as landlords competed to fill a record number of newly completed apartment units, particularly in the high-end luxury category. The relative “boom” in multifamily construction that began in 2014 continued into 2019, but deliveries appeared to have peaked for this cycle during the summer of 2018 at a TTM rate of roughly 365k units. Deliveries will likely remain elevated, however, hovering around a range of 330k-350k through the end of 2020, which amounts to roughly 1.5% per year annual supply growth. Starts and permitting activity has pulled back since mid-2018, and as of September’s data, multifamily starts declined by 1% over the last year, while permits have risen by 3%.

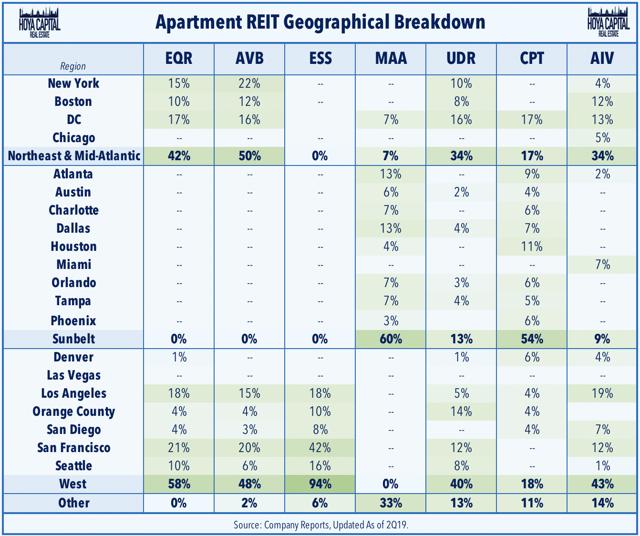

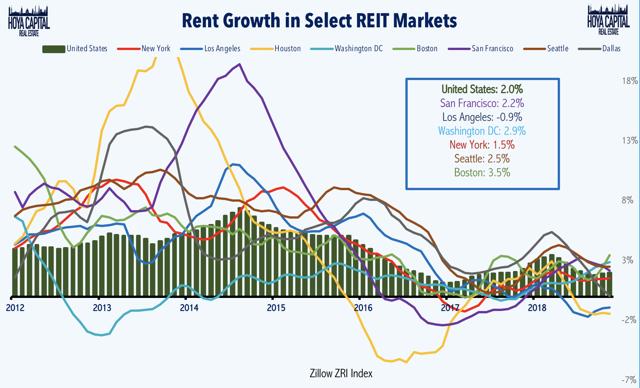

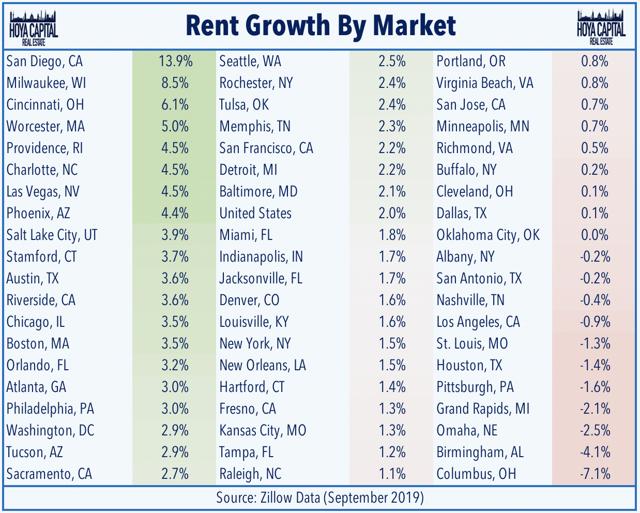

Looking at the sector on a more granular level, as we get later into the current economic cycle, the variance in fundamentals between markets has become less pronounced, as there has been a convergence towards supply/demand equilibrium. Interestingly, markets with higher concentrations of REIT ownership had generally underperformed from 2015 to 2018, as these higher-end markets have generally seen higher levels of supply growth relative to the national average, but that trend has reversed a bit over the last year. The top-6 REIT markets by asset value are San Francisco, Los Angeles, Washington, D.C., New York, Seattle, and Boston, and four of those six are seeing rent growth above the national average, according to Zillow ZRI data.

The convergence in fundamentals is seen through the apartment REIT performance as well, with each of the seven major REITs displaying remarkably consistent operating metrics despite having portfolios in different regions and different rental price points. All seven REITs are projecting same-store revenue growth within a 70-basis point spread of 3.0-3.7% with an average of 3.3%, up from the 2.6% rate achieved in 2018 and the 2.8% rate in 2017. Same-store NOI projections for full-year 2019 are also in a relatively tight spread between 3.1% and 5.0%.

Diving even deeper, we note the rent growth of the top-60 markets, according to the Zillow ZRI Index below. While Zillow’s data is prone to large revisions, it has historically been a decent leading indicator of directional trends in national and regional rent growth. San Diego, Milwaukee, Cincinnati, Worcester, and Providence topped the charts in September, while Columbus, Birmingham, Omaha, Grand Rapids, and Pittsburgh lagged.

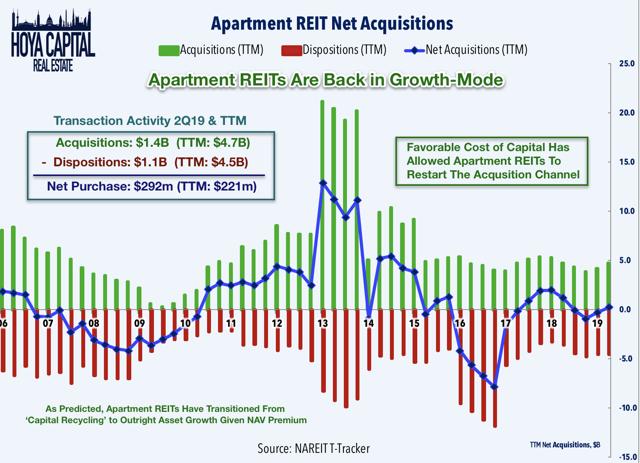

Capital Markets and External Growth

As we’ve been discussing since the start of the year, the “REIT Rejuvenation” of 2019 – through the positive impact on REIT’s cost of capital – has allowed REITs to get back to doing what they do best: external growth. In late 2018, we projected that apartment REITs would become net buyers in 2019 as the early effects of the REIT resurgence pushed equity valuations into territory more favorable for external growth. Currently, apartment REITs trade at a roughly 10% estimated NAV premium, which has begun to grease the wheels for acquisition-fueled external growth. With three solid quarters of net acquisition activity, 2019 may end up being the biggest year for net acquisitions since 2014.

Somewhat counterintuitively, elevated equity valuations (particularly in relation to private market valuations) can be beneficial for REITs, which can utilize this valuable equity as “currency” to accretively acquire new assets and recycle assets that are less strategically valuable. Acquisitions have historically accounted for a sizable percentage of total FFO growth per share across the REIT sector. In part because of the improved cost of capital conditions, five of the seven REITs boosted their full-year Core FFO guidance in the third quarter, which is expected to grow 5.5% in 2019, up from 3.8% last year.

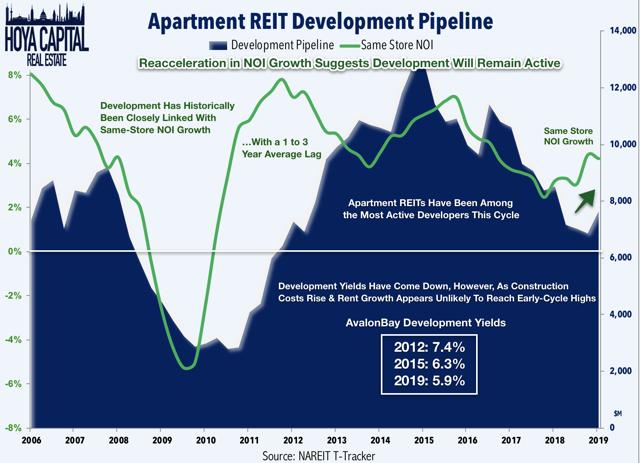

Development yields are an important indicator of future new supply, and low yields should be expected to prevent marginal projects from breaking ground. Contrary to a central contention of many rent control and “Not In My Backyard” advocates, ground-up real estate development isn’t as lucrative of a business as critics believe, confirmed by rather modest development yields achieved by these REITs, yields that are rather meager on a risk-adjusted basis.

Higher construction costs, moderating asset price appreciation, and moderating fundamentals made new incremental development less attractive over the past several years, but many developers continue to see positive value-creation spreads. As we point out below, same-store NOI growth from these apartment REITs has been closely linked with a swelling development pipeline. As of the end of last quarter, AvalonBay Communities still sees roughly 5.9% stabilized yields, compared to capitalization rates around 4.6%. This 130 bps spread compares to the 300 bps+ spreads in 2014-2015.

The Bull and Bear Thesis for Apartment REITs

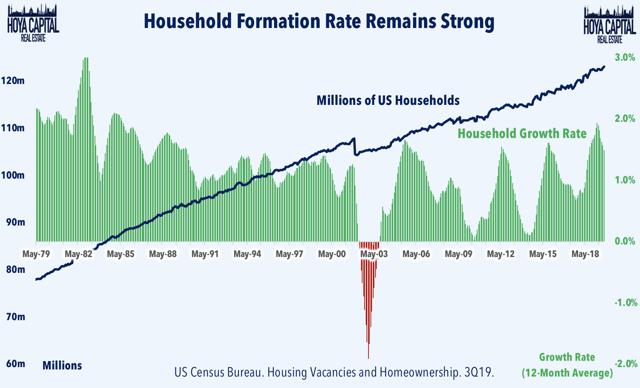

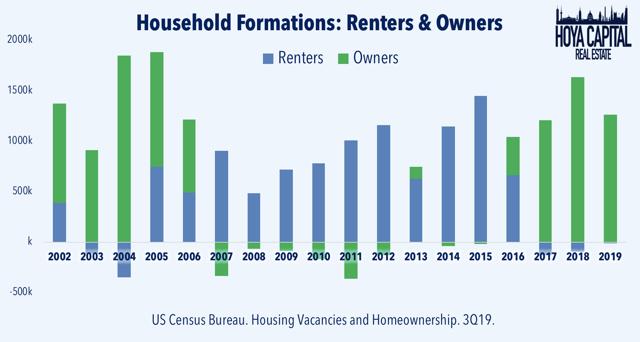

Demand for apartment units is a function of four primary factors: household formations, job growth, income growth, and the propensity to rent versus own. Despite a global economic slowdown this year, the US labor markets have remained remarkably resilient. Wage growth has accelerated from a peak of around 2% in 2016 to more than 3% over the past two years, and real wage growth has been even more impressive, no doubt helped by the deflationary forces inherent with slowing growth outside the US. The strong jobs market powered the best year for household formations in a generation in 2018 with growth above 2.0%, and formations have averaged roughly 1.7% in 2019.

This acceleration in household formations, a phenomenon that we expect to continue into the 2020s, given the demographic wave of millennials entering their late-20s and early 30s, has come at a time of significant and lingering undersupply in the housing markets. Meanwhile, elevated student loan debt burdens, the effects of tax reform on reducing the incentives of homeownership, and a “rent-by choice” lifestyle preference have made this demographic more likely to rent apartments further along into their family and career paths. Below, we outline the five reasons that investors are bullish on apartment REITs.

While demographic trends have been very favorable over the last decade, they will become a headwind by the end of the next decade. Almost 100% of the incremental growth in household formations have gone towards the ownership markets since 2017, but total household growth has kept the vacancy rate of rental households near historic lows. A generation that we dub the “HW Bush Babies” – those born between 1989 and 1993 – is the largest 5-year age cohort in the United States. This abnormally large age cohort, the oldest of which are now entering their 30s, is likely to transition towards the single-family markets with greater frequency over the decade.

Additionally, as discussed above, a core part of our thesis forecasting accelerating apartment fundamentals in 2019 was the significant uptick in the 30-year fixed mortgage rate throughout 2018. At its peak last November, mortgage rates were higher on a year-over-year basis that at any point in the last decade, which significantly tilted the buy vs. rent equation toward the renting markets. Mortgage rate trends have reversed substantially in 2019 and are now lower on a year-over-year basis than at any point in the last decade. While we think that strong household formation growth and decelerating supply growth will be enough to keep rent growth firm, we do see the acceleration waning into 2020 if rates stay near today’s low levels. Below, we discuss the five reasons that investors are bearish on apartment REITs.

Apartment REIT Stock Performance

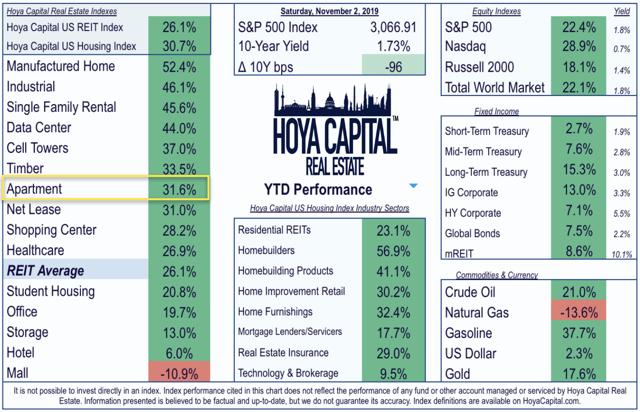

After producing sector-leading returns in 2014 and 2015, apartment REITs underperformed the REIT average in 2016 and 2017 amid lingering concerns regarding oversupply and moderating fundamentals but returned to their winning ways in 2018, producing a total return of 4%. Since the dawn of the Modern REIT Era began in 1994, apartment REITs have produced an average annual total return of 12.5% per year, compared to the 11.5% return on the REIT index through the end of 2018.

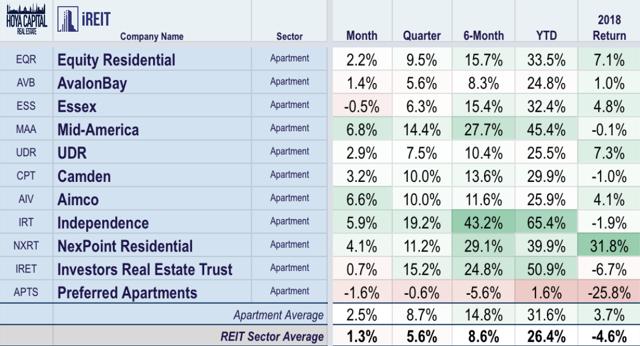

After outperforming the broad REIT index by 8% last year, apartment REITs have again led the gains in the REIT sector this year. Powered by the reacceleration in rent growth discussed above and cooling supply growth, Apartment REITs have climbed by more than 32% so far this year, ahead of both the broad-based REIT ETF (NYSEARCA:VNQ) and the Hoya Capital US Housing Index, which have gained 26% and 31% this year, respectively.

As rent growth has generally been strongest in the non-core and lower-cost markets, the REITs that focus primarily on these price points have outperformed this year. Along with Mid-America, the small-cap REITs have generally been the best performers this year, reversing last year’s underperformance, led by 40%+ gains from Independence, NexPoint, and Investors Real Estate Trust.

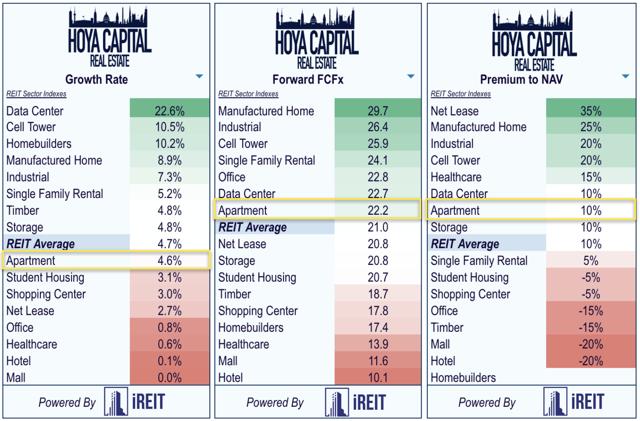

Valuation of Apartment REITs

Apartment REITs appear fairly valued across the metrics that we track. The sector trades at a slight Free Cash Flow premium (aka AFFO, FAD, CAD) to the REIT average, and after accounting for medium-term growth rates, apartment REITs trade roughly in line with the REIT average on the FCF/Growth metric, a metric similar to a PEG ratio. As discussed, apartment REITs now trade at a modest 5-10% NAV premium, which should help to fuel external growth this year following several years of challenging conditions.

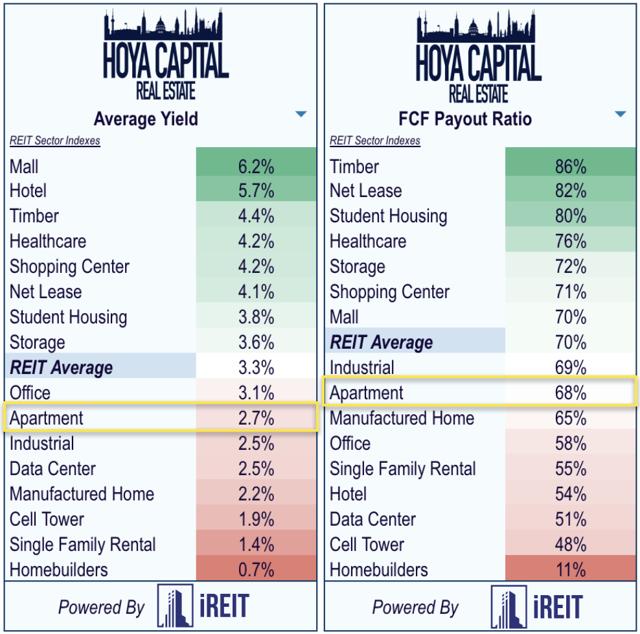

Apartment REIT Dividend Yields

Based on dividend yield, apartment REITs rank in the middle of the sector, paying out an average yield of 2.7%. Apartment REITs payout just around 70% of their available cash flow, towards the lower end of the REIT sector, giving these companies quite a bit of flexibility to take advantage of development opportunities or to increase distributions through higher dividends or share buybacks.

Three of the five small-cap REITs pay a dividend yield at or above 4% but also tend to pay a higher percentage of free cash flows towards the dividend and have significantly higher debt burdens than the seven larger apartments REITs. Interestingly, our research indicates REITs with lower dividend yields have outperformed higher-yielding REITs by 1-3% per year over the past 10- and 20-year periods, suggesting that lower-yielding REITs may be persistently undervalued perhaps due to the “yield-chasing” phenomenon that is particularly common among REIT investors.

Bottom Line: Rent Control Not A Concern for REITs

Roaring Rents: Apartment REITs have delivered a strong 2019 as rent growth reaccelerated this summer to the highest rate since 2016. Occupancy remains near record-highs while turnover is at record-lows. Robust employment and wage gains have powered growth in both renting and owning household formations. Demographics, however, suggest the next decade will be tougher than the last for apartment REITs.

The 2010s will be remembered as a decade of historic underbuilding. Despite a US population nearly double the size of the 1960s, the US produced 30% fewer housing units this decade. Despite overwhelming economic evidence that rent control does more harm than good for renting households, Oregon and California became the first states to enact state-wide rent control laws this year. While bad news for renters, the impact on REITs will be minimal. However, we expect reduced investment in at-risk markets and prefer sunbelt-focused REITs with a friendlier business environment.

Over-regulation is at the root of the housing shortage, and there’s a risk that these politically popular but economically irrational “solutions”, including rent control, will hurt landlords and renters alike. Ultimately, the solution to the mounting housing shortage is, in theory, rather simple: build more housing. The rising regulatory burden faced by housing developers has unsurprisingly corresponded to the significant rise in housing inflation during this time – manifesting in higher rents and home values, a trend that we expect to persist well into the next decade.

If you enjoyed this report, be sure to “Follow” our page to stay up-to-date on the latest developments in the housing and commercial real estate sectors. For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Student Housing, Single-Family Rentals, Manufactured Housing, Cell Towers, Healthcare, Industrial, Data Center, Malls, Net Lease, Shopping Centers, Hotels, Office, Storage, Timber, and Real Estate Crowdfunding.

Announcement: Hoya Capital Teams Up With iREIT

Hoya Capital is excited to announce that we’ve teamed up with iREIT to cultivate the premier institutional-quality real estate research service on Seeking Alpha!

While we’ll continue providing our free sector reports, iREIT subscribers will now get exclusive access to our expanded real estate coverage including:

- Expanded REIT Rankings Reports With Exclusive Content

- Real-Time Economic Analysis & Commentary

- Hoya Capital “Real Estate Robo Investor” ETF Model Portfolios

Sign-up for the 2-week free trial today!

Disclosure: I am/we are long AVB, AIV, ESS, EQR, CPT, MAA, UDR, VNQ, Z. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. All commentary published by Hoya Capital Real Estate is available free of charge and is for informational purposes only and is not intended as investment advice. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.

Hoya Capital Real Estate advises an ETF. In addition to the long positions listed above, Hoya Capital is long all components in the Hoya Capital Housing 100 Index. Real Estate and Housing Index definitions and holdings are available at HoyaCapital.com.