Individual investors are getting anxious, just like the major institutions. They’re withdrawing billions of dollars from the stock market.

According to S&P Global Market Intelligence data, institutions have taken out a net total of $333.9 billion from stocks in the past year. Individual investors have withdrawn $28 billion.

A significant amount of money has been flowing into cash and similar low-risk investments. As of May 10, the total assets in money market funds reached a record-breaking $5.3 trillion.

Once the market recovers from its pessimistic state, stocks begin to rally…

These fund managers might start doubting their decisions and reinvesting their money into the market soon.

You see, fund managers generally have job security during a bear market, even if they’re losing money. However, missing out on the bull market is what could cost them their jobs.

Currently, the leading sector is semiconductors. This sector is one of my preferred trades because it typically has the right amount of volatility, and its movements are somewhat more predictable.

We recently closed our position on AMD after a long battle. However, we still anticipate that the stock will reach around $105 before experiencing a corrective decline.

It seems that prediction is still holding true…

Taiwan Semiconductor (TSM) is also experiencing a rally.

The upper dotted line represented a resistance level, and as you can see, the stock had a significant price gap up above it yesterday.

Both of these stocks have made substantial gains, so a pullback is likely. However, I also have concerns that the semiconductor sector might continue its significant upward trend.

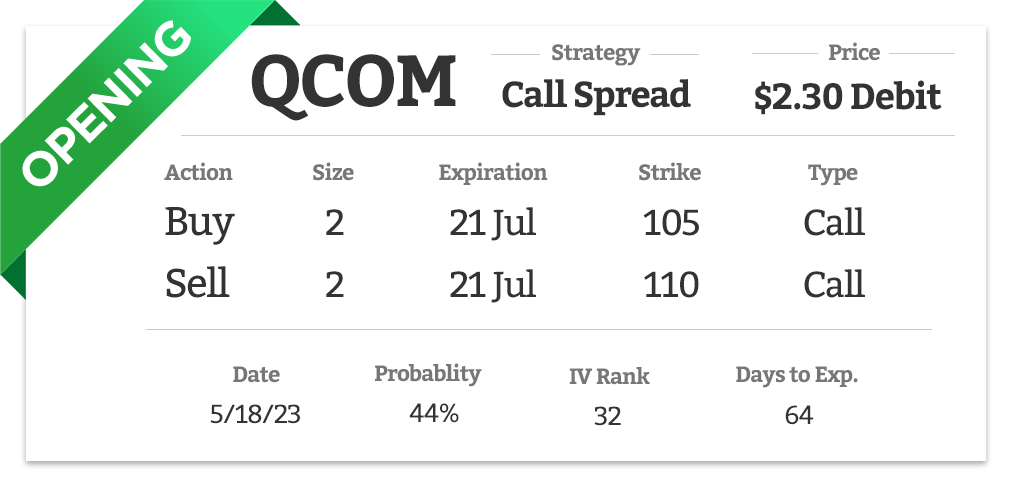

That’s why I’m searching for valuable opportunities within the semiconductor sector. One notable contender that hasn’t participated in the recent semiconductor rally is Qualcomm (QCOM), a semiconductor manufacturer worth billions of dollars.

Let’s examine the chart…

Over the past few trading sessions, Qualcomm has started to consolidate and has triggered a bullish RSI failure swing. These failure swings are rare occurrences, but when they happen, I always pay attention.

A bullish failure swing happens when the RSI drops below 30 (indicating oversold conditions), rebounds above 30, experiences a slight decline but remains above 30, and ultimately surpasses its previous high.

In the above chart, you can see that QCOM’s RSI dropped below 30, all the way down to 26, then rose to 34 before falling back to 31, but staying above the oversold threshold of 30.

Now we just need to observe if the RSI breaks above the previous high of 34. If it does, it’s a strong indication that the stock could surge. Because it just hit 35, that is the indicator we need.

If the semiconductor sector as a whole experiences a minor decline, considering that QCOM is already weakened, it is likely to have limited downside potential.

However, if there is more room for growth in the semiconductor sector, or even after a slight pullback in the short term, Qualcomm is in an excellent position to make significant gains.