Trade Statistics

At Option Strategies Insider, we want to be as forth coming as possible about our trades and results. Our main goal is to combine solid research with the most powerful option trading strategies, giving us a high probability to profit, a strong winning percentage, and a healthy return on capital. The following represent our Executive portfolio statistics.

89% Success Rate Since 2015

Recently Closed Trades

Here is a list of recently closed trades our members were able to take advantage of.

| Position | Strategy | Days Held | ROC % | Annual ROC % |

| NXPI | Butterfly Spread | 151 | 6% | 15% |

| CAT | Butterfly Spread | 189 | 41% | 80% |

| IBM | Bear Put Spread | 1 | 25% | 9125% |

| TQQQ | Bull Call Spread | 131 | 14% | 39% |

| QBTS | Bull Call Spread | 13 | 25% | 702% |

| UPRO | Bull Call Spread | 3 | 44% | 5360% |

| SOXL | Stock | 9 | 13% | 536% |

| TNA | Stock | 9 | 2% | 68% |

| GLD | Bull Call Spread | 6 | 45% | 2731% |

| SOXL | Stock | 7 | 29% | 1513% |

| TNA | Buy Write | 4 | 8% | 713% |

| CRM | Bull Call Spread | 22 | 19% | 319% |

| GDX | Bear Put Spread | 14 | 11% | 274% |

| TSM | Bull Call Spread | 1 | 15% | 5615% |

| TSLA | Bull Call Spread | 25 | -27% | -398% |

| XLF | Bear Put Spread | 184 | 14% | 28% |

| SMH | Bull Call Spread | 4 | 17% | 1587% |

| VTI | Bear Put Spread | 42 | 38% | 326% |

| BUD | Bull Call Spread | 132 | 59% | 163% |

| SMH | Bear Put Spread | 18 | 23% | 460% |

| ARKK | Bear Put Spread | 39 | 53% | 499% |

| CL | Bull Call Spread | 6 | 43% | 2607% |

| QQQ | Bear Put Spread | 178 | -100% | -201% |

| TLT | Bear Put Spread | 5 | 56% | 4076% |

| SMH | Bear Put Spread | 25 | 48% | 704% |

| ARKK | Bear Put Spread | 13 | 33% | 936% |

| TLT | Straddle | 44 | 27% | 223% |

| IWM | Bear Put Spread | 14 | 80% | 1951% |

| IWM | Bear Put Spread | 74 | 4% | 20% |

| AMD | Iron Condor | 68 | 1% | 5% |

| XLU | Bear Put Spread | 35 | 5% | 56% |

| USCI | Bull Call Spread | 82 | 9% | 40% |

| BITO | Bull Call Spread | 91 | -100% | -401% |

| WELL | Butterfly Spread | 69 | -94% | -536% |

| XLF | Bear Put Spread | 6 | 65% | 3954% |

| FCX | Bull Call Spread | 31 | 5% | 57% |

| XLU | Bull Call Spread | 12 | 46% | 1387% |

| TQQQ | Bull Call Spread | 22 | 31% | 510% |

| XLU | Bull Call Spread | 34 | 142% | 1520% |

| FCX | Bear Put Spread | 9 | 66% | 2669% |

| TWLO | Bull Call Spread | 44 | 19% | 156% |

| PCTY | Bull Call Spread | 41 | 41% | 367% |

| IWM | Butterfly Spread | 153 | 77% | 184% |

| AMD | Bull Call Spread | 17 | 67% | 1431% |

| FDX | Bull Call Spread | 41 | 184% | 1641% |

| WBA | Bull Call Spread | 91 | -100% | -401% |

| MRK | Bull Call Spread | 23 | 12% | 187% |

| TLT | Bull Call Spread | 5 | 108% | 7900% |

| XLU | Bear Put Spread | 7 | 90% | 4701% |

| BRK.B | Bull Call Spread | 16 | 54% | 1242% |

| V | Butterfly Spread | 18 | 42% | 853% |

| AMD | Bull Call Spread | 37 | 63% | 622% |

| SPY | Bull Call Spread | 12 | 33% | 1003% |

| QQQ | Bull Call Spread | 15 | 20% | 487% |

| XLF | Short Put | 35 | 2% | 16% |

| XLC | Long Put | 72 | -75% | -673% |

| SPY | Long Put | 39 | -44% | -441% |

| XLI | Bear Put Sread | 64 | -98% | -638% |

| GDX | Butterfly Spread | 251 | 3% | 4% |

| AMD | Butterfly Spread | 12 | 10% | 304% |

| AMD | Bear Put Spread | 3 | 43% | 5251% |

| HRL | Butterfly Spread | 51 | 88% | 626% |

| SBUX | Bull Call Spread | 64 | -15% | -85% |

| TLT | Bull Call Spread | 296 | 1% | 1% |

| XLU | Bull Call Spread | 9 | 40% | 1616% |

| TSLA | Bull Call Spread | 4 | 3% | 277% |

| QQQ | Bull Call Spread | 3 | 15% | 1812% |

| TXN | Bull Call Spread | 2 | 80% | 14559% |

| SMH | Bull Call Spread | 5 | 43% | 3103% |

| XLU | Butterfly Spread | 16 | 30% | 684% |

| HSY | Bull Call Spread | 44 | 3% | 27% |

| NVDA | Bull Call Spread | 3 | 34% | 4104% |

| CAH | Bear Put Spread | 15 | 161% | 3914% |

| CAT | Bull Call Spread | 86 | 28% | 120% |

| XLU | Butterfly Spread | 9 | 58% | 2333% |

| SPHR | Bull Call Spread | 5 | 50% | 3650% |

| SPY | Butterfly Spread | 62 | 69% | 409% |

| XLF | Butterfly Spread | 249 | -66% | -96% |

| SMH | Bull Call Spread | 97 | 33% | 122% |

| AAPL | Bull Call Spread | 23 | 38% | 605% |

| MOS | Bull Call Spread | 1 | 45% | 16,329% |

| IWM | Bull Call Spread | 14 | 17% | 445% |

| SQ | Bull Call Spread | 38 | 72% | 692% |

| BOIL | Bull Call Spread | 353 | -73% | -75% |

| CAT | Bull Call Spread | 14 | 29% | 745% |

| XLY | Iron Condor | 75 | 36% | 176% |

| TSLA | Bull Call Spread | 49 | 2% | 12% |

| AMD | Bull Call Spread | 10 | 30% | 1095% |

| CVS | Bull Call Spread | 119 | -100% | -306% |

| ZS | Bull Call Spread | 6 | 67% | 4076% |

| AMD | Bull Call Spread | 20 | 34% | 621% |

| LEVI | Buy-Write | 54 | 5% | 37% |

| NVO | Butterfly Spread | 30 | 14% | 170% |

| TXT | Bull Call Spread | 66 | 4% | 22% |

| NKE | Bull Call Spread | 16 | 105% | 2395% |

| AVGO | Bull Call Spread | 6 | 65% | 3925% |

| TSLA | Bull Call Spread | 6 | 70% | 4182% |

| QCOM | Bull Call Spread | 12 | 60% | 1785% |

| AMD | Bull Call Spread | 127 | 13% | 37% |

| QQQ | Bull Call Spread | 21 | 14% | 235% |

| ZS | Bull Call Spread | 28 | 15% | 201% |

| DE | Bull Call Spread | 6 | 20% | 1190% |

| FDX | Strangle | 78 | -34% | -157% |

| UDOW | Bull Call Spread | 5 | 65% | 4710% |

| SMH | Bear Put Spread | 71 | -100% | -514% |

| TLT | Strangle | 5 | 43% | 3146% |

| ARKK | Bear Put Spread | 16 | 70% | 1564% |

| AMD | Bear Put Spread | 7 | 38% | 2005% |

| NVDA | Bear Put Spread | 2 | 43% | 7821% |

| SMH | Bull Call Spread | 2 | 21% | 3744% |

| AMD | Bear Put Spread | 1 | 29% | 10,429% |

| SMH | Bull Call Spread | .5 | 45% | 32,850% |

| TLT | Bull Call Spread | 26 | 84% | 1183% |

| CAT | Bear Put Spread | 45 | 2% | 16% |

| FRC | Iron Condor | 23 | 15% | 233% |

| AMD | Bear Put Spread | 1 | 28% | 10,330% |

| TSM | Bull Call Spread | 24 | 41% | 618% |

| YELP | Bear Put Spread | 86 | -35% | -148% |

| QQQ | Bear Put Spread | 6 | 72% | 4398% |

| IWM | Bear Put Spread | 5 | 4% | 304% |

| XLF | Bear Put Spread | 15 | 104% | 2533% |

| BILL | Bear Put Spread | 11 | 54% | 1797% |

| ON | Bear Put Spread | 15 | 34% | 835% |

| TSM | Bear Put Spread | 21 | 138% | 2407% |

| IWM | Bear Put Spread | 52 | 4% | 30% |

| IYT | Bear Put Spread | 14 | 47% | 1229% |

| KMX | Bear Put Spread | 18 | 38% | 780% |

| SMH | Iron Condor | 7 | 17% | 865% |

| BITO | Bull Call Spread | 88 | -62% | -478% |

| QQQ | Bear Put Spread | 20 | 44% | 877% |

| FDX | Bear Put Spread | 37 | 2% | 22% |

| SNOW | Bear Put Spread | 2 | 26% | 4750% |

| CAT | Bear Put Spread | 25 | 102% | 1490% |

| AMD | Bear Put Spread | 20 | 100% | 1825% |

| QQQ | Bear Put Spread | 36 | 21% | 223% |

| IWM | Bear Put Spread | 4 | 53% | 4791% |

| SPOT | Bear Put Spread | 5 | 106% | 7747% |

| DE | Bear Put Spread | 14 | 31% | 815% |

| TWLO | Bear Put Spread | 9 | 42% | 1716% |

| SQ | Bear Put Spread | 16 | 72% | 1652% |

| QQQ | Bear Put Spread | 20 | 56% | 1023% |

| SMH | Bear Put Spread | 16 | 62% | 1404% |

| TGT | Butterfly Spread | 112 | 27% | 88% |

| NOC | Bull Call Spread | 10 | 31% | 1147% |

| SMH | Bull Call Spread | 2 | 26% | 4803% |

| FCX | Bull Call Spread | 4 | 57% | 5158% |

| CVS | Bull Call Spread | 2 | 19% | 3380% |

| IWM | Bear Put Spread | 63 | 8% | 34% |

| TSM | Bear Put Spread | 11 | 32% | 1050% |

| PYPL | Bull Call Spread | 87 | -68% | -791% |

| SMH | Bear Put Spread | 1 | 38% | 13774% |

| FDX | Bear Put Spread | 3 | 109% | 13290% |

| XLF | Iron Condor | 21 | 32% | 556% |

| BRK-B | Butterfly | 41 | 14% | 123% |

| VIAC | Bull Call Spread | 8 | 44% | 2008% |

| FSM | Bull Call Spread | 213 | -100% | -171% |

| AMD | Call | 5 | 24% | 1748% |

| MSFT | Bull Call Spread | 5 | 34% | 2506% |

| LMT | Iron Condor | 154 | 6% | 14% |

| RHI | Bull Call Spread | 22 | 34% | 568% |

| WMT | Butterfly | 21 | 39% | 673% |

| M | Bear Put Spread | 55 | 59% | 394% |

| HSY | Bull Call Spread | 6 | 31% | 2028% |

| EXPD | Bull Call Spread | 14 | 100% | 2607% |

| XOP | Iron Condor | 70 | 20% | 104% |

| FDX | Bull Call Spread | 21 | 56% | 975% |

| LRCX | Bull Call Spread | 23 | 51% | 802% |

| GOOGL | Iron Condor | 43 | 13% | 110% |

| SQ | Bull Call Spread | 16 | 103% | 2361% |

| MSFT | Bull Call Spread | 26 | 28% | 390% |

| AAL | Bear Put Spread | 49 | 1% | 7% |

| AMD | Bull Call Spread | 8 | 50% | 2281% |

| MDGL | Bull Put Spread | 100 | -100% | -365% |

| CLR | Bull Put Spread | 3 | 25% | 456% |

| ALLY | Butterfly | 20 | 49% | 886% |

| GE | Iron Condor | 17 | 42% | 905% |

| IWM | Single Call | 2 | 51% | 9342% |

| XLB | Bull Call Spread | 9 | 70% | 2827% |

| EXPE | Iron Condor | 23 | 24% | 385% |

| CVS | Butterfly | 20 | 22% | 395% |

| STX | Bull Put Spread | 34 | 29% | 307% |

| SPOT | Bull Call Spread | 9 | 33% | 1352% |

| LMT | Bull Call Spread | 2 | 49% | 8946% |

| ITB | Butterfly | 36 | 40% | 408% |

| MSFT | Bull Call Spread | 1 | 36% | 13140% |

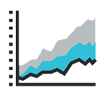

Annual Return on Capital

Once we sift through the noise, what matters most is the return on capital. If you’re not making money you’re not moving forward. The chart below represents our annual returns over the last several years.

Strategy Percentage

The following graph illustrates the distribution of our entered strategy types. Trades that take market direction into account are exemplified by spreads, buy writes, or single options. On the other hand, market-neutral approaches find representation in strategies such as iron condors, butterflies, strangles, and straddles.

Trade Performance History

2024 Trade Performance

2023 Trade Performance

2022 Trade Performance

2021 Trade Performance

2020 Trade Performance

2019 Trade Performance

2018 Trade Performance

2017 Trade Performance

2016 Trade Performance

IF YOU DON’T AGREE WITH (OR CANNOT COMPLY WITH) OUR TERMS OF SERVICE OR POLICIES, THEN YOU MAY NOT USE THE THIS SITE AND MUST EXIT IMMEDIATELY. PLEASE BE ADVISED THAT YOUR CONTINUED USE OF THIS SITE AND INFORMATION WITHIN SHALL INDICATE YOUR CONSENT AND AGREEMENT TO THESE TERMS AND CONDITIONS.

Option Strategies Insider may express or utilize testimonials or descriptions of past performance, but such items are not indicative of future results or performance, or any representation, warranty or guaranty that any result will be obtained by you. These results and performances are NOT TYPICAL, and you should not expect to achieve the same or similar results or performance. Your results may differ materially from those expressed or utilized by Option Strategies insider due to a number of factors.

Copyright 2020- Option Strategies Insider - All Rights Reserved