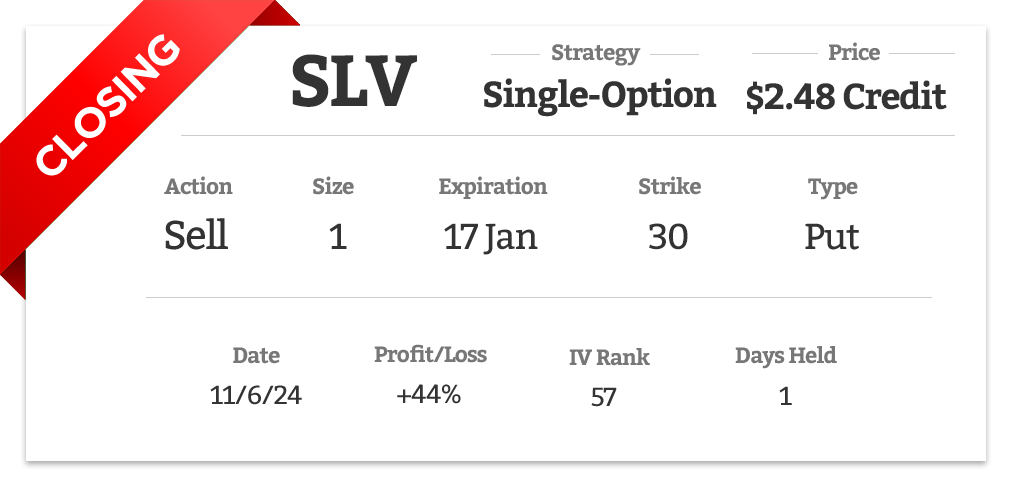

Silver, like much of the broader market, is experiencing considerable volatility today, falling 5% in response to Trump’s win. At this point, I’m planning to close out the puts for a one-day gain of 44%, which translates to an extraordinary 16,128% annualized return.

Looking at SLV’s chart, it’s forming what appears to be an almost textbook Elliott Wave impulse pattern.

The chart highlights a five-wave sequence followed by a corrective wave. This pattern suggests the potential for another upward impulse wave. There’s a chance that prices could dip as low as $27.90 before rebounding, but my strategy is to lock in the gains from today’s put movement. Then, I plan to hold on and wait for a recovery over the next couple of months to exit the calls with a profit as well.