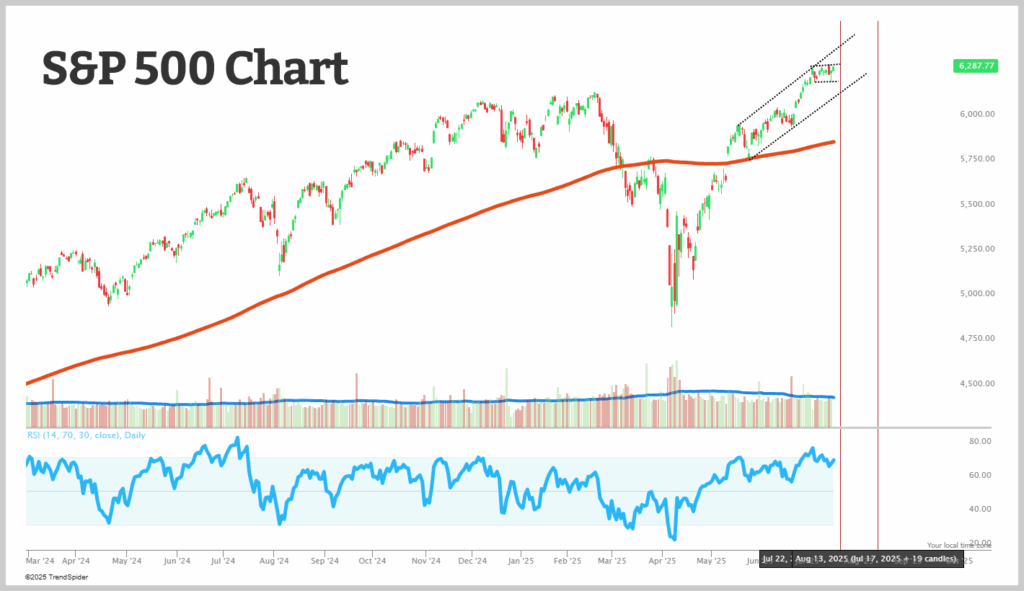

Stocks bounced back yesterday, but the question now is whether that strength can carry forward.

Let’s examine the S&P 500 more closely…

Between the black dotted lines, the S&P 500 has largely been moving sideways since early July.

This kind of consolidation is typical of a small wave 4 in Elliott Wave theory.

The key will be how things unfold going into early next week, and even more so during the first half of August.

We may continue to see this sideways movement for a few more days before another breakout attempt kicks off next week.

Alternatively, the market could dip slightly (as recent pullbacks have been fairly minor), which could mark a short-term bottom ahead of another move higher.

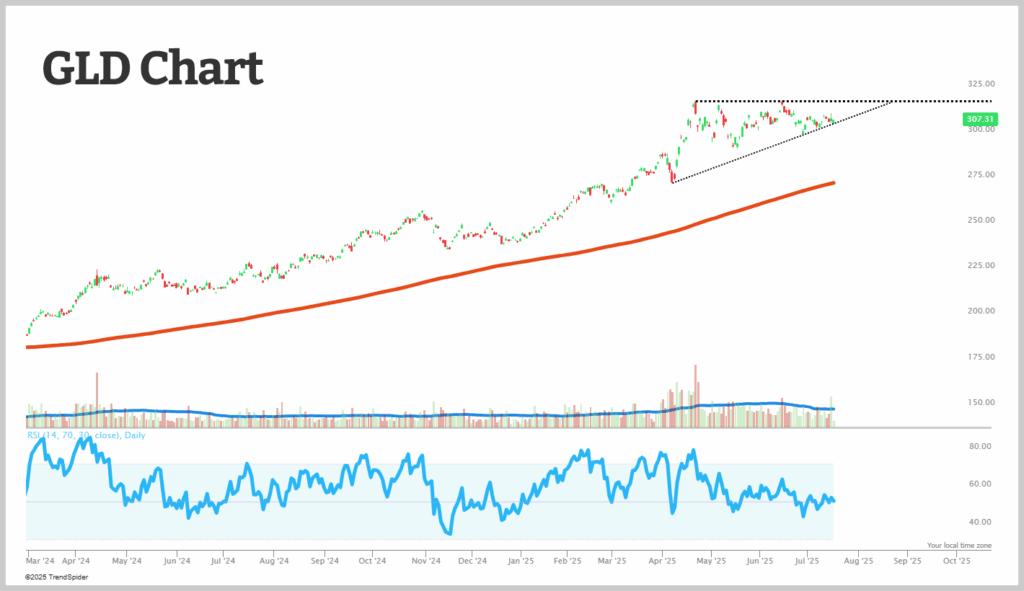

Now let’s shift over to gold, which is still managing to hold its support levels even as equities rally…

If gold maintains its footing here, there’s a good chance it will push through recent resistance.

However, if support fails to hold, we could see a short-term dip, potentially offering a strong setup for bullish call option trades.

For now, it’s best to stay patient and let the setup develop a little further.