Yesterday, interest rates initially moved lower but later reversed course and ended the day in positive territory.

Technology stocks showed a mixed performance, most semiconductor names surged on the news, but many broader tech names in the sector didn’t follow suit.

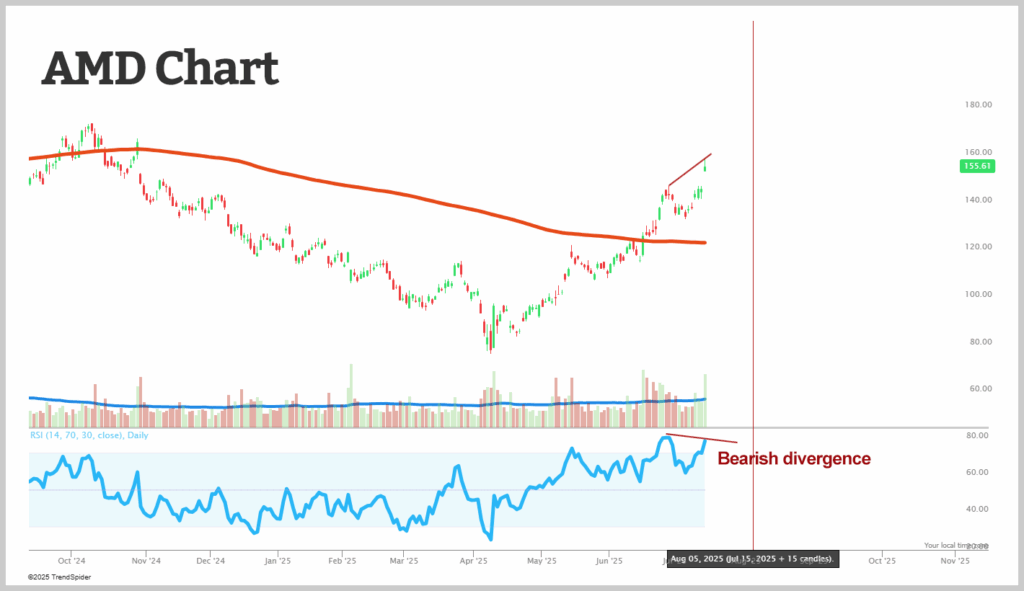

One area of concern is AMD, especially since we entered put positions before yesterday’s announcement.

Let’s examine the chart…

Earnings are on the calendar for August 5, which will likely serve as a major catalyst and drive the next significant move in the stock.

At the moment, there’s a bearish divergence forming, the stock price is trending upward, but the Relative Strength Index (RSI) is showing weakness over the same period.

Yesterday’s rally was quickly pulled back, resulting in a shooting star candlestick, another bearish signal that suggests caution.

We’ll need to keep a close eye on the price action over the next few sessions to determine our next steps.

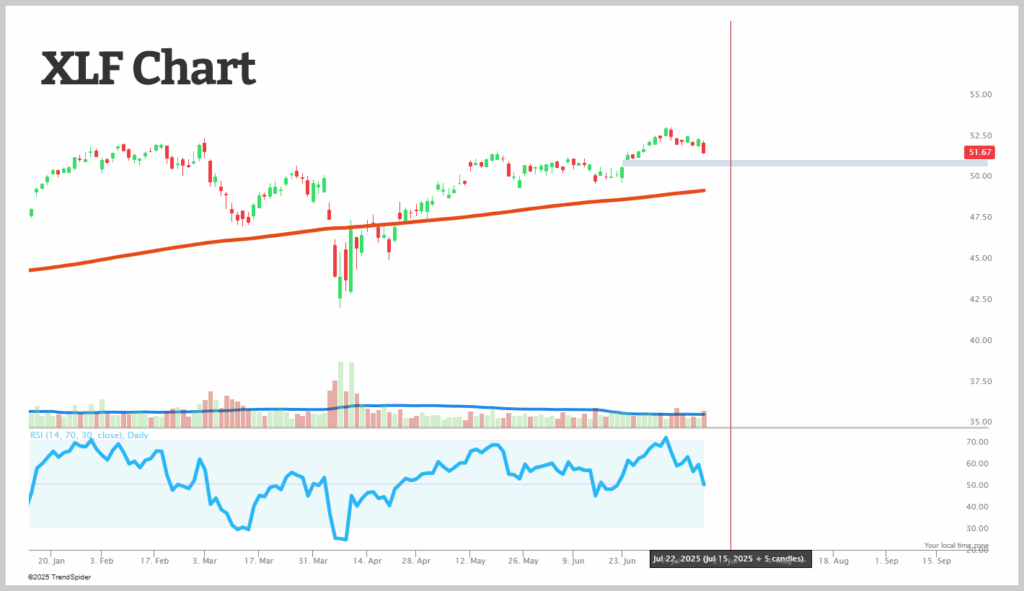

Turning to the financial sector, JPMorgan Chase (JPM) posted a strong earnings report to start the season, but Wells Fargo (WFC) is dragging the group dow, falling nearly 5%.

Take a look at this chart of the Financial Select Sector SPDR Fund (XLF) to help shape your outlook for the coming week…

In the near term, July 21 and 22 (Monday and Tuesday) may serve as a potential inflection point.

While the Nasdaq and semiconductor stocks are pushing to new highs, XLF is flatlining. Could this signal that financials will pull back into early next week, setting up a short-term bottom?

It’s a real possibility. On this chart, there are indicators for a potential RSI reversal — assuming prices can hold above key support levels, we could see a rebound heading into the first half of August.

Financials may remain stagnant while tech continues to climb. Any pullback early next week might be a good opportunity to adjust AMD and buy the dip.