Inflation numbers continue to meet or exceed expectations, while the Federal Reserve remains focused on cutting interest rates. Meanwhile, the stock market is beginning to react to signals from the bond market.

Today, we’ve seen declines across key indices and sectors, including the S&P 500, NASDAQ, semiconductors, financials, and small caps. Could this be the start of a larger move?

Unlike the robust postelection rallies we experienced in 2016 and 2020, this time we’re not seeing a broad market surge. Instead, there’s significant divergence across sectors, signaling uncertainty.

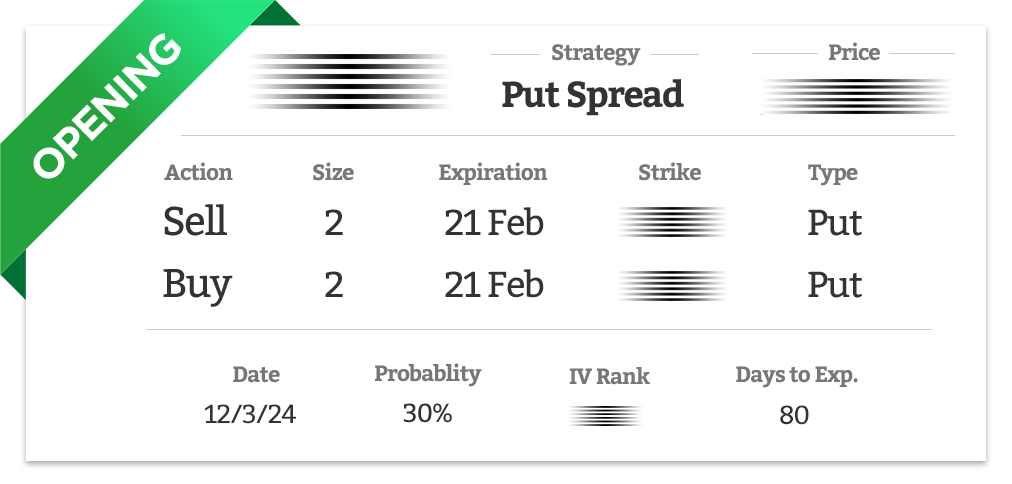

Because of this, I believe it’s time to cautiously reenter a position with strong potential for success.

![]() This trade report is for our Executive and Ultra members only! To read the rest of this report you will need to select one of the options below…

This trade report is for our Executive and Ultra members only! To read the rest of this report you will need to select one of the options below…