The U.S. added only 12,000 jobs, falling significantly short of the 100,000 that economists had anticipated.

Combined with persistent “sticky inflation” that remains stubbornly high, the stagflation scenario I discussed last month is showing no signs of improvement.

Following the report, interest rates declined, and stock futures climbed, but this market reaction could be premature given the upcoming election and the Federal Reserve meeting next week.

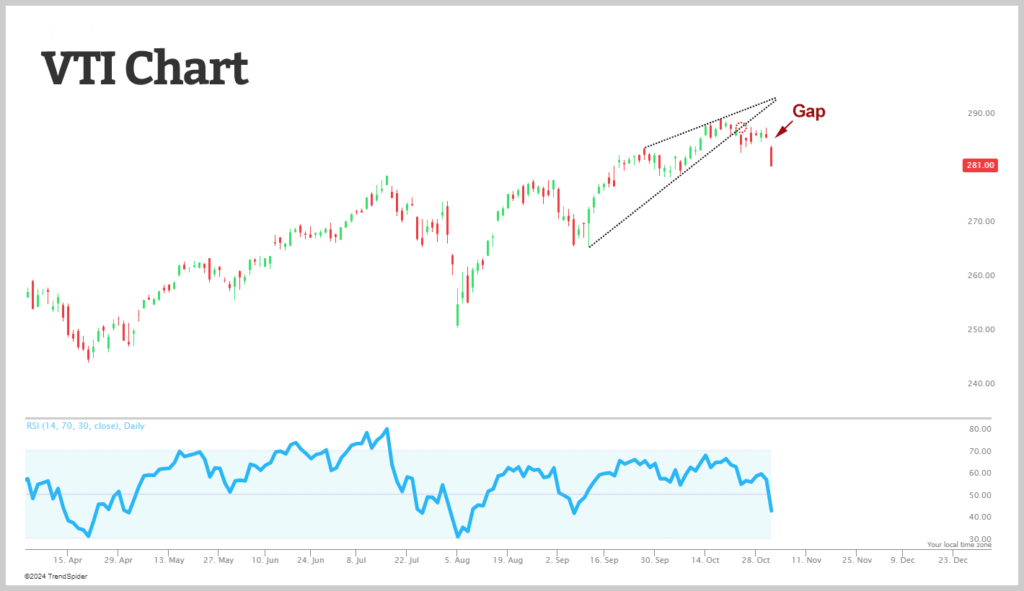

Take a look at the Vanguard Total Stock Market (VTI)…

Here we notice a significant drop from the rising wedge or ending diagonal formation. The key question now is whether VTI can “close the gap” from yesterday. Achieving that would be impressive, but any rally would likely face strong resistance.

As we head into the market open, it will be crucial to watch how trading unfolds. Yesterday, I emphasized the importance of being patient ahead of next week, but we still want to take advantage of the heightened volatility, so look for trades to drop at the start of next week.

For now, let’s observe how the markets respond to this critical employment data.