The rising rate environment has caused growth companies to crash and burn over the last two years, but as rates now start to fall, the trend is going to reverse, and the profits that come with investing in the right growth companies will be substantial.

On November 30, 2022, Sam Altman, the CEO of OpenAI, made a significant announcement via Twitter that introduced a groundbreaking technology reshaping businesses ever since its inception.

The concept of chatbots—computer programs adept at understanding and emulating human conversation in text—has existed for decades.

The first-known chatbot, ELIZA, was pioneered by MIT computer scientist Joseph Weizenbaum in 1966. However, OpenAI’s ChatGPT revolutionized conversing with computers just five months ago.

Termed as a large language model (LLM), ChatGPT possesses the ability to promptly respond to inquiries on diverse subjects and generate various forms of written content, spanning from poetry to business strategies and even computer programming.

It engages in extensive, fluid text conversations that often resemble human interaction and demonstrates the capacity to solve problems necessitating logical reasoning and interpretation.

A mere two months post-launch, ChatGPT garnered 100 million active users, achieving a milestone that took the immensely popular social media app TikTok nine months to reach. According to Swiss banking giant UBS, this marked ChatGPT as the fastest-growing software application in history.

The effectiveness of generative AI models such as ChatGPT relies heavily on the quality of the data they are trained on. This is where our latest recommendation comes into play.

Founded in 1988, this recommendation was established with the fundamental idea of engineering top-tier data to empower organizations across various industries in making smarter decisions.

Among the nascent stage of the generative AI surge lies substantial potential for us to make 10 times on our money over the next few years.

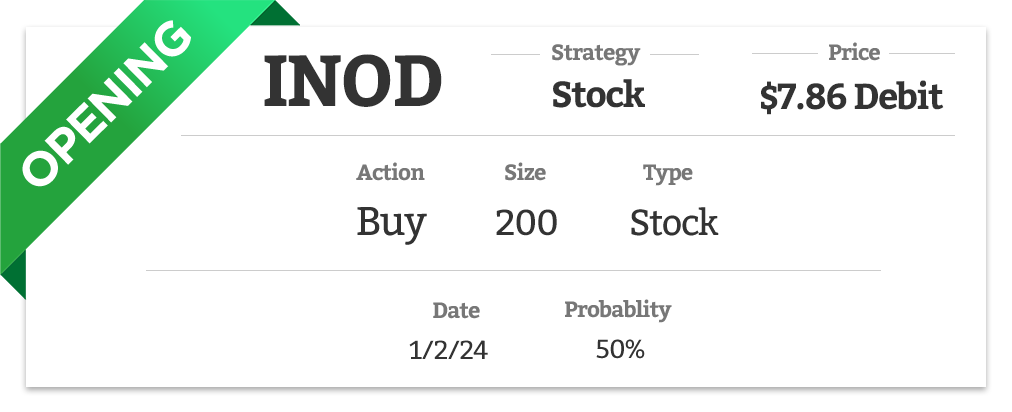

Today, we spotlight Innodata (INOD), a company entrenched in two highly competitive yet profitable sectors.

One facet of Innodata’s business revolves around knowledge process outsourcing (KPO), enabling businesses to outsource specific tasks, like in-depth analysis of intricate legal or medical documents, to freelancers. This aids Innodata’s clients in optimizing their workforce without compromising talent or capabilities.

Additionally, Innodata boasts a lengthy track record of aiding publishers and information-services clients in transitioning their print-based offerings to digital formats.

However, this industry poses significant competition and limited prospects for differentiation.

In 2017, Innodata found its footing by establishing Innodata Labs, leading to the creation of Goldengate, an exclusive AI engine. According to CEO Jack Abuhoff, Goldengate empowers Innodata to craft high-performance, state-of-the-art models addressing real-world issues.

Goldengate serves as the backbone of Innodata’s primary areas of innovation and positions the company ideally to capitalize on the escalating demand for generative AI training data in the future.

One of the primary focuses is data annotation—an indispensable aspect of the learning process for any AI system. Innodata employs over 4,000 subject matter experts (SMEs) to annotate diverse content, ranging from contracts to investor conference calls and satellite imagery, supporting data in over 25 languages.

Furthermore, Goldengate extends its AI capabilities to Innodata’s industry platforms, Agility and Synodex.

Agility facilitates essential functions for PR professionals, aiding in tasks like drafting press releases.

With more than 1,400 clients, including prominent names like Best Buy, McDonald’s, and Nestlé, Agility recently introduced PR CoPilot, the PR industry’s pioneering generative AI solution for crafting press releases and media pitches.

Synodex utilizes AI to convert medical records into digital data, processing over 1.5 million pages of data monthly.

These reports, delivered via Software as a Service (SaaS), are instrumental in clients’ underwriting decisions, with 18 insurance customers, including John Hancock and one of the leading undisclosed life insurers in the United States.

Is Now the Right Time?

The rise in interest rates impacted growth, but the outlook is shifting. As inflation comes into focus and the Fed plans to decrease rates in 2024, the tide is expected to turn.

This presents an opportunity to jump in early on companies poised for this shift.

Daniel Ives, a senior tech sector analyst at Wedbush Securities, estimates the potential of AI to be worth around $800 billion. Going even further, venture-capital firm Sequoia Capital believes generative AI could yield “trillions of dollars of economic value” considering its impact on billions of people globally.

Real-life applications show promising results:

- Dr. Jeffrey Ryckman reduced insurance-claim rebuttal letter writing time from 30 minutes to just one minute.

- Data engineer Paul De Salvo pre-empts his boss’s arguments to prepare successful counterarguments, a tactic admired by many.

- Author Paul Gamlowski evaluates reader comprehension of his stories pre-publishing, enhancing their impact.

Recognizing this potential, tech giants like Alphabet, Microsoft, and Amazon are in a competitive race to lead the AI chatbot market, as stated by Abuhoff during a fourth-quarter call.

Innodata, listed among Microsoft, Amazon, and Apple as customers on its website, stands to benefit from this heated competition among industry giants.

What Sets Innodata Apart?

Innodata developed its proprietary AI platform, Goldengate, with a distinctive advantage. Unlike competitors who pieced together AI models from various acquisitions, Goldengate seamlessly integrates into Innodata’s existing workflows.

The platform effectively combines unstructured data from different sources, enabling customers to derive cohesive insights. Abuhoff highlights this unique ability during the third-quarter call, emphasizing the seamlessness in analytics provided by Goldengate.

Financial Picture

Innodata’s shift to an AI-centric model since 2017 required significant investment. Over the last five years, spending surged on technology infrastructure, AI operations, and sales personnel, reflecting in increased SG&A and capital spending percentages.

However, the bulk of this spending was financed through free cash flow (FCF) and existing cash, keeping diluted shares low and maintaining a debt-free status—qualities sought after in high-growth stocks.

As of September 2023, Innodata holds $14.8 million in cash and plans to fund some capital spending for the year.

Who’s Investing?

Institutional investors hold 19% of Innodata’s shares. Among the top 10 shareholders are prominent names like Vanguard, BlackRock (BLK), and SSGA Funds Management.

Vanguard stands as the second-largest institutional shareholder, with its stake increasing significantly from 44,000 shares in 2005 to 1.16 million shares today, approximately 4.2% of the outstanding shares. The largest shareholder remains Las Vegas-based investment firm Luzich Partners, owning 5.7% of the outstanding shares.

Financial-data company FactSet notes the absence of Wall Street analysts officially covering Innodata or providing earnings estimates. However, with the expected evolution of the company’s narrative, analysts are anticipated to begin coverage, likely leading to an increase in institutional ownership.

Eminent investors already backing Innodata indicate a shared recognition of its potential. This ownership is anticipated to grow gradually alongside increased attention from Wall Street, potentially driving share prices higher.

Risks Involved

Investing in growth stocks like Innodata involves higher-than-average risk. Here are the risks associated with the company:

Firstly, the anticipated exponential growth in the generative-AI industry might face delays or may not materialize as expected. One of the critical challenges in this domain revolves around ownership issues concerning the data used to train AI models, leading to legal disputes such as Getty Images suing Stability AI for alleged copyright infringement.

Meanwhile, Microsoft and OpenAI are involved in a suit of their own.

Secondly, despite industry-wide growth, there’s no guarantee that Innodata will enhance its profitability and FCF as projected. Collaboration among leading AI companies might limit reliance on any single service provider, demanding continued innovation and effective execution from Innodata.

Lastly, Innodata’s financial performance may fluctuate significantly from quarter to quarter, despite a general upward trend. Anticipate notable fluctuations in financial results.

In Conclusion

If everything aligns favorably for Innodata, there’s a potential estimation of $100 per share within three to five years, reflecting a substantial increase.

The competitive landscape in generative-AI emphasizes the significance of high-quality data. Innodata’s extensive experience in crafting unique data for clients, coupled with its proprietary Goldengate AI platform, positions the company as a significant player in the unfolding narrative of the generative-AI sphere in the coming years.