We initially jumped into Target (TGT) last December when the market started to show some cracks. Target’s strong sales growth and low earnings multiple made the company attractive in a market where long-term potential was no longer appreciated.

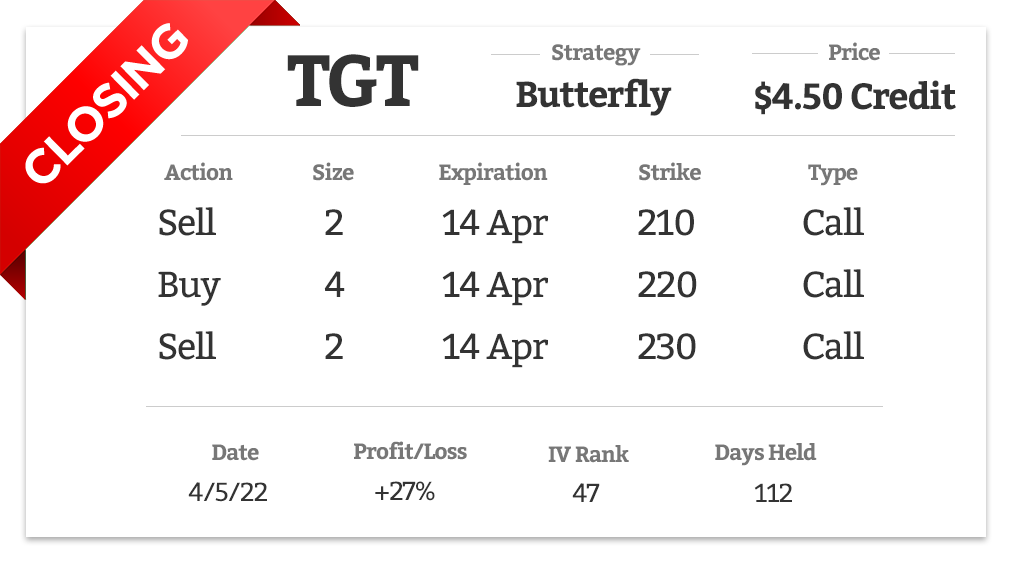

However, not even Target, with solid cash flows, could not withstand the selloff. The stock traded down, causing us to lose our original investment. However, we still felt the price decline was unwarranted, so we made an aggressive bullish butterfly spread in an adjustment.

Two weeks later, Target’s fourth-quarter earnings were far better than expected, and the stock had an immediate 10% surge, hovering right around the short strikes of our butterfly.

We have now made back all the money that would be lost on the original trade plus another $135 profit on a minimum order. Today I’d like to close a position for a 112-day 27% return, which works out to be a 88% annualized. Certainly not a blockbuster, but it’s always nice to adjust the loser and turn it into a winner.