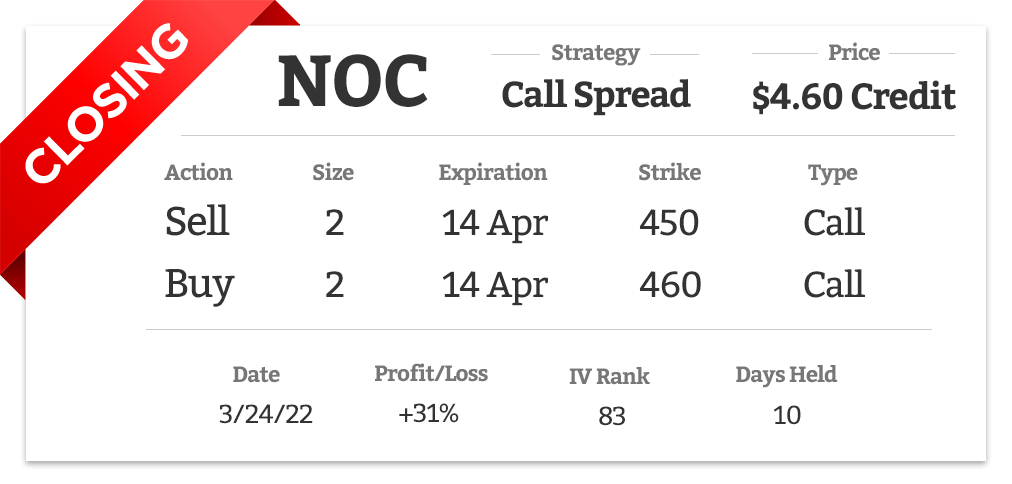

I’d gotten up at 4 AM on March 16 and saw the market would have a strong opening, so I decided to write out our closing report Northrop Grumman (NOC).

When I finished the report, despite the rest of the market, I noticed all the military stocks were down on the day… It appeared some negative news in Lockheed Martin stifled the sector. It’s funny how random lousy news always seems to find a way to get you. That’s the life of a trader.

Overall wasn’t too worried about it. With the war going on in Europe, military stocks will be in high demand. You have to reassess situations constantly. We may have to hold the trade for a bit longer and not squeak out as much profits, but we take with the market gives us.

Today I want to sell our position for a credit of $4.60, which gives us a $220 profit on minimum order. This works out to be a 10-day 31% return or 1147% annualized.